The digitisation of our financial lives has made everything more convenient. We no longer have to carry wads of cash or make countless trips to the bank. Unfortunately, it has also opened up new opportunities for fraudsters. Credit card fraud is one of the most common types of financial and banking fraud, with losses amounting to billions of dollars each year.

According to the Federal Trade Commission, there were almost 389,845 reported credit card fraud cases in the USA in 2021 alone, and in the UK, in the last three months of 2021, credit card fraud rose by 42%, the highest rate since 2017. But don’t worry—there are ways to detect and prevent this type of maleficence. This article will outline some common methods fraudsters use and what steps we can take to protect ourselves.

Table of Contents

ToggleWhat is credit card fraud?

Credit card fraud occurs when someone uses your credit card or account information without your permission. As you know, the money you charge to your credit card is not actually yours; it’s borrowed from the bank and must be paid back with interest. Fraudsters use stolen information to make unauthorised purchases, leaving you on the hook for those charges.

This inclusive term covers a wide range of illegal activities, which we’ll cover in greater detail below. Credit card fraud is also part of the larger crime of identity theft, in which a person steals and uses another individual’s personal information for their own gain.

How credit card fraud can affect you

It’s important to understand that credit card fraud affects us on a societal level. From the individual consumer to the issuing bank, passing by businesses and government agencies. Everyone is affected by this problem.

On a personal level, fraudulent charges on your credit card can lead to financial loss and damage to your credit scores. The credit bureaus may flag your account as fraudulent, causing difficulties when applying for loans or other financial products. In some cases, it can also lead to criminal charges if the fraud is severe enough.

On a larger scale, credit card fraud leads to billions of dollars in losses for banks each year. This, in turn, can lead to higher interest rates and fees for consumers as banks try to recoup their losses. Government agencies, such as law enforcement, also spend considerable resources investigating and prosecuting these crimes.

Finally, businesses are gravely affected by credit card fraud. Both online and physical stores lose sales to fraudulent transactions, leading to loss of revenue and damage to their reputation. Oftentimes, they are also responsible for covering the cost of fraudulent charges.

For example, an online retailer may have to reimburse a customer for charges made with a stolen credit card. However, the pair of shoes was still shipped to the fraudster, meaning the business lost both the sale and merchandise.

Taking the correct fraud prevention measures on time can help businesses keep their customers happy and save on fraud losses.

How to monitor your credit accounts

Stay vigilant by regularly checking your credit card and bank account statements. Set aside some time each month to review all transactions for accuracy and consistency. Keep an eye out for any unfamiliar charges or discrepancies, no matter how small they may seem.

Consider enrolling in credit monitoring services offered by many financial institutions. These services can provide alerts for any significant changes to your credit report, such as new accounts opened in your name or changes to your credit score.

Take advantage of free credit reports available through annualcreditreport.com. By law, you’re entitled to one free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – every 12 months. Review these reports regularly to ensure all information is accurate and to spot any signs of identity theft or fraud.

Use mobile banking apps and online account management tools provided by your financial institutions. These platforms often offer features like real-time transaction alerts, which can notify you of any suspicious activity as soon as it occurs.

If you do notice any unauthorized charges or suspicious activity, don’t hesitate to take action. Contact your credit card issuer or bank immediately to report the issue. They can help you freeze your account to prevent further unauthorized charges and work with you to resolve any fraudulent activity. Remember, quick action can help minimize the impact of identity theft and protect your financial security.

How to protect yourself from credit card fraud

Although credit card fraud is a significant problem, there are steps we can take as individuals to protect ourselves and prevent becoming a victim of credit card fraud. By staying vigilant and taking precautions, we can minimise the impact of fraudulent activity on both ourselves and society as a whole.

Monitor your accounts and statements regularly: Check your credit reports, online account and bank statements for any suspicious activity. Keep an eye out for charges you don’t recognise or unusual spending patterns. It’s a good idea to set up fraud alerts on your credit card account to notify you of any major credit changes or purchases.

Keep your credit card secure: Don’t share your credit card information with anyone, and always keep an eye on it when making a physical purchase. Be cautious when shopping online, and make sure the website is secure before entering your card details.

Protect your personal information: Your birthdate and other sensitive information can be used to access your credit accounts. Avoid giving out personal data unless absolutely necessary. Be specifically cautious of social media and individuals that reach out, fraudsters tend to share a link which will steal your personal data or ask for personal details.

Report any suspicious activity immediately: Contact your credit card issuer immediately if you notice anything unusual on your account or suspect fraud. They may freeze your account to prevent further unauthorised charges and work with you to resolve the issue.

Steps to take if you’re the victim of credit card fraud

Discovering that you’re a victim of credit card fraud can be alarming, but taking immediate action is crucial to minimize the impact. Here are steps to follow if you find yourself in this situation:

Notify your credit card issuer

Contact your credit card issuer as soon as possible to report the fraudulent activity. They can freeze your account to prevent further unauthorized charges and work with you to resolve the issue.

Place a fraud alert on your credit report

Consider placing a fraud alert on your credit report with the major credit bureaus—Equifax, Experian, and TransUnion. This alert notifies creditors to take extra steps to verify your identity before approving new credit accounts or changes to existing ones.

Report the credit card fraud to law enforcement

File a report with your local law enforcement agency, providing as much detail as possible about the fraudulent transactions and any information you have regarding the perpetrator.

Contact the credit bureaus

Reach out to each of the major credit bureaus to dispute any fraudulent information on your credit report. They can assist you in removing inaccurate information and restoring your credit history.

Additional steps to consider:

Keep detailed records

Document all communications with your credit card issuer, law enforcement, and the credit bureaus regarding the fraud. This information may be useful in resolving any disputes or issues that arise.

Review your accounts regularly

Continue monitoring your credit card and bank account statements for any additional unauthorized activity. Promptly report any new instances of fraud to your credit card issuer.

Consider identity theft protection services

Explore options for identity theft protection services that offer additional monitoring and assistance in resolving fraud-related issues.

By taking swift and decisive action, you can mitigate the impact of credit card fraud and work towards restoring your financial security. Remember to stay vigilant in monitoring your accounts and protecting your personal information to prevent future incidents of fraud.

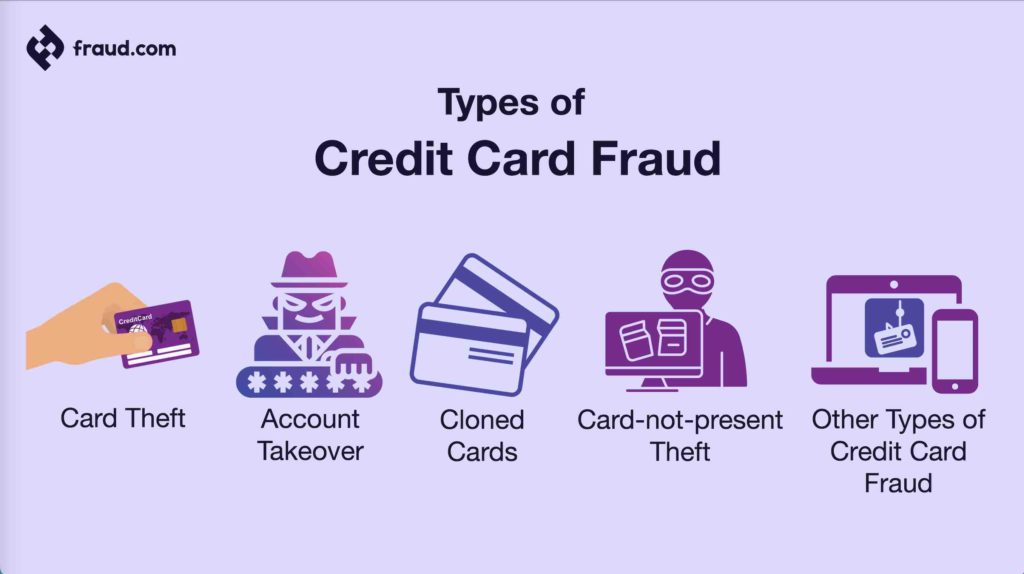

Types of credit card fraud

It also helps to be familiar with the different types of credit card fraud, so you can better recognise them. Although scammers are constantly coming up with new schemes, here are some common examples:

Card theft

This type of credit card fraud is self-explanatory. The physical card is stolen and used for unauthorised charges. This can happen through pickpocketing, mail theft, or data breaches at a store or restaurant where you have used your card. The thief will then use the card for their own purchases or sell it to someone else who will do so.

That’s why it’s important to report a lost card immediately.

Account takeover

An account takeover happens online. A fraudster gains access to your credit card account and makes changes to billing information or spending limits. They may do this by posing as you, using stolen account numbers obtained through data breaches or phishing scams.

To protect against an account takeover, use strong passwords (including a mix of numbers, letters, and special characters), and don’t use the same password for multiple accounts. Also, be wary of suspicious emails or calls asking for your personal information. It’s best to directly contact your card issuer if you have any concerns about your account.

Cloned cards

One of the more sophisticated forms of fraud, a cloned card, is when scammers use stolen credit card information to duplicate the physical card. They can then use it for their own purchases or sell it to others. How do they get this information?

It can come from skimming devices attached to card readers in stores or gas pumps. Information can also be bought and sold on the dark web.

Card-not-present theft

Some products or services can be purchased without physically presenting a card. For instance, online shopping or over-the-phone transactions. Fraudsters can use stolen credit card numbers to make these purchases, often using fake identities and addresses. If they have the card information and personal identity details, they can make purchases without ever possessing the actual card.

Other types of credit card fraud

There are also frauds related to credit card applications and identity theft. A fraudster may use stolen information or fake documents to apply for a credit card in someone else’s name, and then make purchases with it.

In addition, be aware of scams involving credit repair or debt relief offers that promise to fix your credit problems for a fee. These are often scams and can end up causing more harm to your credit.

Detecting and preventing credit card fraud

All this seems scary, doesn’t it? But we can take steps to protect ourselves from credit card fraud and help detect it. Thankfully, for every scam method a fraudster comes up with, banks and businesses are also developing new ways to detect fraud and prevent these schemes.

One way is through monitoring of account activity. If a sudden change in spending behaviour or location is detected, the credit card company may freeze the account. They’ll contact the cardholder for identity verification or authentication before allowing any further charges. They may also flag purchases of high-risk items, such as plane tickets or jewellery, which are common targets for fraudsters.

Once fraud has been detected, it’s crucial to act quickly. Immediately contact your credit card company and go through their process for reporting fraud. That may involve cancelling the card and getting a new one, as well as filing a police report if necessary.

Our solution – aiReflex

In addition to these measures, our team at aiReflex has developed artificial intelligence technology that can detect credit card fraud in real time using advanced analytics and machine learning. This technology can analyse massive amounts of data, making it faster and more accurate than manual monitoring of accounts.

Our solution not only helps catch fraudulent activity but also minimises false positives and reduces the inconvenience to legitimate customers. Protect your business with a central dashboard to monitor and manage fraud and focus on what matters most—serving your customers.

Our rule-based and machine-learning algorithms improve as they learn from past fraud patterns, ensuring that your business is protected with the most up-to-date technology. Visit our website to learn more about how aiReflex can help keep your credit card transactions safe from fraud.

Credit card fraud FAQs

Here are answers to some frequently asked questions about credit card fraud:

| Question | Answer |

|---|---|

| What should I do if I suspect that I’ve been a victim of credit card fraud? | If you suspect fraudulent activity on your credit card, contact your credit card issuer immediately to report the issue. They can help you take steps to secure your account and investigate the unauthorized charges. |

| How can I protect myself from credit card fraud when shopping online? | When shopping online, make sure to only use secure websites with HTTPS encryption. Avoid entering your credit card information on unsecured or unfamiliar websites. Additionally, consider using a virtual credit card for online transactions, which offers an extra layer of security. |

| Can I dispute fraudulent charges on my credit card? | Yes, you can dispute fraudulent charges on your credit card by contacting your credit card issuer and providing details about the unauthorized transactions. They will investigate the charges and, if found to be fraudulent, remove them from your account. |

| Will I be held responsible for fraudulent charges on my credit card? | In most cases, you will not be held responsible for fraudulent charges on your credit card as long as you report them promptly to your credit card issuer. Federal law limits your liability for unauthorized transactions to $50, and many credit card issuers offer zero liability protection. |

| How can I monitor my credit card accounts for fraudulent activity? | You can monitor your credit card accounts for fraudulent activity by regularly reviewing your account statements and transaction history. Many credit card issuers also offer mobile apps and online account management tools with features like real-time transaction alerts to help you stay informed about account activity. |

| What steps can I take to prevent credit card fraud? | To prevent credit card fraud, keep your credit card information secure, monitor your accounts regularly for unauthorized activity, and be cautious when sharing personal information online or over the phone. Additionally, consider enrolling in credit monitoring services and using strong, unique passwords for your accounts. |