In today’s digital-first world, businesses face increasing risks of financial crime, including fraud, money laundering and terrorist financing, and identity theft. As these crimes grow more sophisticated, organizations must adopt robust measures to protect themselves and their customers. One of the most critical tools in this fight is KYC compliance.

KYC, or Know Your Customer, is a regulatory and operational framework that ensures businesses verify the identity of their customers. It’s not just a legal requirement, it’s a cornerstone of effective fraud prevention and risk management. This article explores what KYC compliance means, why it matters, and how it integrates with modern fraud detection and prevention solutions.

Table of Contents

ToggleWhat is KYC compliance?

KYC compliance refers to the process of verifying the identity of customers before or during the onboarding process. It involves collecting and analyzing customer information, such as government-issued IDs, proof of address, other relevant documents and additional information as required. The goal is to ensure that customers are who they claim to be, reducing the risk of fraudulent activities.

For businesses, especially financial institutions, KYC compliance is not optional. Regulatory bodies like the Financial Crimes Enforcement Network (FinCEN), the Financial Action Task Force (FATF), and the European Union’s AMLD (Anti-Money Laundering Directive) mandate strict adherence to KYC standards. Non-compliance can result in hefty fines, reputational damage, and even legal action.

Why KYC compliance is critical for fraud prevention

Fraudsters are constantly evolving their tactics, making it harder for businesses to detect and prevent fraudulent activities. KYC compliance acts as the first line of defense by:

- Preventing identity fraud: By verifying customer identities, businesses can ensure that fraudsters cannot use stolen or fake identities to open accounts or conduct transactions.

- Reducing money laundering risks: KYC processes help identify suspicious activity and flag high-risk customers, such as politically exposed persons (PEPs), making it harder for criminals to launder money through legitimate businesses.

- Enhancing Trust and Security: Customers are more likely to trust businesses that prioritize security and transparency, leading to stronger customer relationships.

Integrating KYC compliance into fraud prevention solutions ensures that only legitimate customers gain access to services, while fraudsters are kept at bay.

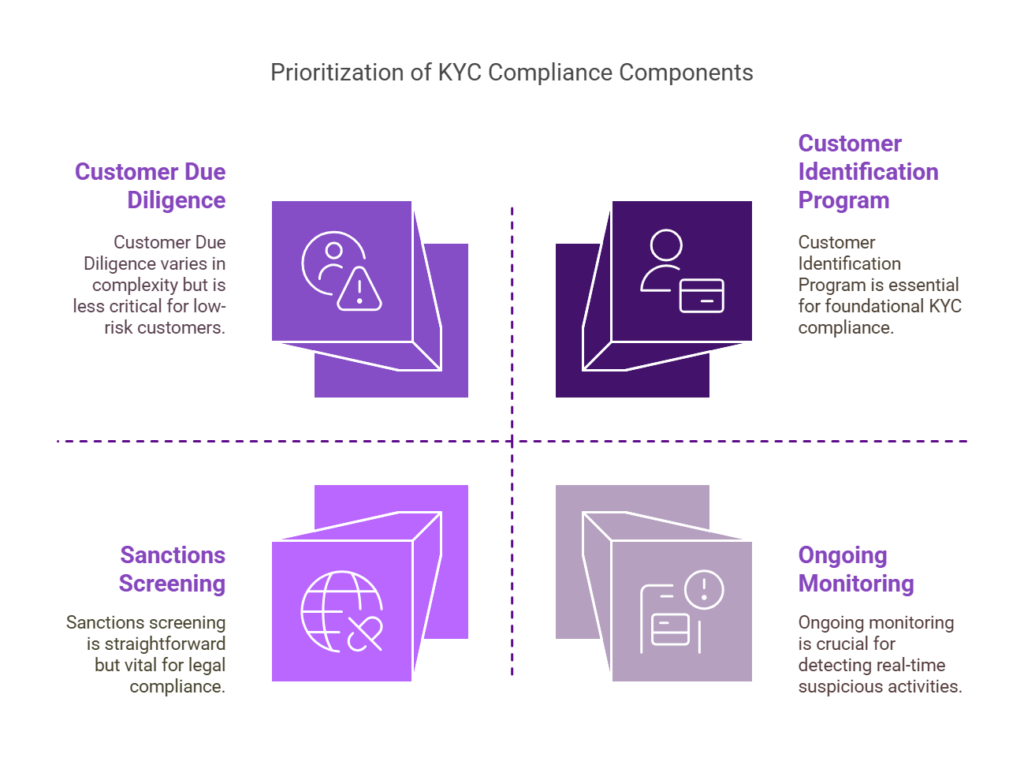

Key components of an effective KYC compliance program

A robust KYC compliance program goes beyond basic identity verification. It includes the following components:

1. Customer Identification Program (CIP)

The CIP is the foundation of KYC compliance. It involves collecting and verifying customer information, such as name, date of birth, address, and identification numbers. Advanced solutions like use AI-powered tools to cross-check this data against global databases for accuracy.

2. Customer Due Diligence (CDD)

CDD involves assessing the risk level of each customer. Low-risk customers may require minimal verification, while high-risk customers (e.g., politically exposed persons (PEPs) or those from high-risk jurisdictions) undergo enhanced due diligence (EDD).

3. Ongoing monitoring

KYC compliance doesn’t end after onboarding. Continuous monitoring of customer transactions and behavior helps detect suspicious activity in real time. Fraud orchestration platforms like fcase automate the detection and response to potential threats.

4. Sanctions screening

Businesses must screen customers against global sanctions lists to ensure they are not dealing with individuals or entities involved in illegal activities.

The role of fraud prevention solutions in strengthening KYC compliance

Fraud prevention solutions and KYC compliance go hand in hand. While KYC ensures that customers are verified at the onboarding stage, fraud detection and prevention solutions provide ongoing protection against evolving threats. Together, they create a comprehensive defense against financial crimes.

Here’s how fraud prevention solutions enhance KYC compliance:

- Automated identity verification: Platforms like Udentify use AI and machine learning to verify identities in real time, reducing manual errors and speeding up the onboarding process.

- Behavioral analytics: Tools like aiReflex analyze customer behavior to detect anomalies and flag potentially fraudulent activities, even after the initial KYC check.

- Seamless integration: Modern fraud prevention tools integrate seamlessly with KYC systems, creating a unified approach to risk assessment and compliance.

By combining KYC compliance with advanced fraud prevention solutions, businesses can build a robust anti-fraud strategy that adapts to new threats and regulatory changes.

How KYC compliance integrates with fraud prevention solutions

Modern fraud prevention solutions leverage KYC compliance to create a seamless and secure customer experience. Here’s how:

AI-powered identity verification: Artificial intelligence and machine learning enable businesses to verify identities quickly and accurately. Tools like Udentify can detect forged documents, analyze facial biometrics, and cross-reference data in seconds.

Fraud orchestration platforms: Platforms like fcase bring together KYC compliance, transaction monitoring, and risk assessment into a single, unified system. This holistic approach allows businesses to detect and prevent fraud at every stage of the customer journey.

Real-time risk scoring: By combining KYC data with behavioral analytics, businesses can assign risk scores to customers in real time. This helps prioritize high-risk cases and streamline the verification process for low-risk customers.

The future of KYC compliance: trends to watch

As technology evolves, so does KYC compliance. Here are some trends shaping the future of KYC and fraud prevention:

- Digital identity solutions: Blockchain-based digital identities and decentralized identity systems are gaining traction, offering a more secure and efficient way to verify customers.

- Biometric authentication: Facial recognition, fingerprint scanning, and voice authentication are becoming standard in KYC processes, enhancing accuracy and security.

- Regulatory Technology (RegTech): RegTech solutions are automating compliance processes, reducing the burden on businesses and ensuring adherence to evolving regulations.

The importance of KYC compliance for financial institutions

Financial institutions are particularly vulnerable to financial crimes due to the high volume of transactions and the complexity of their operations. For these organizations, KYC compliance is not just a regulatory requirement, it’s a critical component of their risk management strategy.

Challenges Faced by Financial Institutions

- High volume of transactions: The sheer number of transactions makes it difficult to manually verify each one, increasing the risk of oversight.

- Complex regulatory landscape: Financial institutions must comply with multiple regulations across different jurisdictions, making compliance a complex and resource-intensive process.

- Evolving threats: Fraudsters are constantly developing new tactics, requiring financial institutions to stay ahead of the curve.

How KYC compliance helps

- Streamlined onboarding: Automated identity verification tools enable financial institutions to onboard customers quickly and securely.

- Enhanced risk assessment: By integrating KYC data with fraud detection tools like aiReflex, financial institutions can assess risk more accurately and in real time.

- Proactive fraud prevention: Continuous monitoring and ongoing monitoring help detect and prevent suspicious activity before it escalates.

Best practices for implementing KYC compliance

To maximize the effectiveness of KYC compliance, businesses should follow these best practices:

- Leverage technology: Use AI-powered tools to automate identity verification and fraud detection.

- Conduct regular audits: Regularly review and update KYC processes to ensure compliance with evolving regulations.

- Train employees: Provide ongoing training to employees on KYC compliance and fraud prevention best practices.

- Monitor high-risk customers: Implement enhanced due diligence (EDD) for high-risk customers, such as politically exposed persons (PEPs).

- Integrate systems: Use fraud orchestration platforms like fcase to create a unified approach to KYC compliance and fraud prevention.

Conclusion: KYC compliance is non-negotiable

In an era where financial crime is on the rise, KYC compliance is no longer just a regulatory checkbox, it’s a strategic imperative. By implementing robust KYC processes and integrating them with advanced fraud prevention solutions, businesses can protect themselves, their customers, and their reputation.

For organizations looking to stay ahead of fraudsters and comply with global regulations, investing in KYC compliance and fraud prevention solutions is essential. Tools like Udentify, aiReflex, and fcase provide the technology and expertise needed to build a comprehensive anti-fraud strategy.