With the increasing popularity of crypto assets, there has also been a comparable increase in crypto fraud and crypto scams, also known as DeFi (Decentralised Finance) fraud. This article discusses crypto fraud and how to prevent and protect against it.

Table of Contents

ToggleWhat is Crypto Fraud?

Crypto fraud refers to all events or transactions which lead to individuals losing their crypto assets to fraud and scams, this mainly happens due to the use of fake and stolen identities by fraudsters. Essentially because fraudsters have exploited security weaknesses in crypto exchanges and other crypto and DeFi organisations due to the lack of strong Identity Verification and Authentication.

Crypto assets are any kind of digital assets that are cryptographically secured and represent the digital value of the asset. Investing in cryptocurrency and other crypto assets are all decentralised investments and therefore it can be seen as DeFi fraud too.

They are typically stored, transferred, or traded electronically. Crypto assets include cryptocurrencies such as Bitcoin and Ethereum, NFTs, utility tokens and security tokens.

4 Scenarios of Crypto Fraud

The increasing interest in crypto assets provides fraudsters a new opportunity to execute their tactics and explore multiple ways to commit crypto fraud. There are many ways in which crypto fraud can happen, but they have the same objective: to steal the user’s hard-earned crypto assets.

The following are a few of many scenarios:

1. Fraudsters can hack a user’s crypto wallet and steal their cryptocurrency and other crypto assets. The most common way which fraudsters gain access and control to the user’s wallet accounts is through phishing, smishing and vishing, and installing malware on their devices. Making this a triple act of fraud, involving account takeover, phishing, and crypto fraud.

2. Fraudsters often use social media platforms to convince users about investment or mining opportunities offering high profits. Asking for a payment in cryptocurrency, making them victims of investment fraud too. The crypto exchange can’t do anything to retrieve the user’s assets because they’re not regulated.

3. Initial coin offering scams refers to the first offering of a cryptocurrency. They make users buy a promising cryptocurrency which has been purely fabricated for fraud and scam purposes.

4. Fraudsters also commit what are known as “scams on scams.” This means that they target existing victims who are vulnerable and promise to help them get their losses back. But instead, they just end up taking more money from them.

Centralised Finance (CeFi) and Decentralised Finance (DeFi)

Centralised Finance refers to the traditional financial practices by banking institutions which are controlled centrally. On the other hand, Decentralised Finance (DeFi) is a recent shift from traditional centralised financial systems. Instead of having third party intermediaries which are typically involved in traditional banking such as brokerages and exchanges.

DeFi enables peer-to-peer finance with the use of decentralised technologies and cryptocurrency which are built on the blockchain. The purpose of this is to manage financial transactions. Such revolutionary financial changes may also bring threats that naturally happen as we adapt to them. With the rise of DeFi, there has also been a large increase in crypto fraud.

DeFi has a lot of potential for fraud because there are no intermediaries between users. All activity is automated with smart contracts. A recent article points out the absence of regulations within DeFi.

DeFi projects should work in a way to prioritise the protection of their customers’ assets. Having strong systems for fraud detection and prevention to mitigate risks around crypto fraud and scams as the user’s assets aren’t regulated or protected due to the absence of a central intermediary entity.

The Blockchain and Cryptocurrency

All digital data is stored in blockchains electronically. In simple words, a blockchain stores a distributed database which is shared on the nodes of a computer network. Blockchains remove the need for a third party and regulators as records of transactions are meant to be secured and decentralised.

Cryptocurrency is the most well-known type of crypto asset and with the increase of interest in digital assets, there is also an increase in fraud, for instance, the recent hype and increase of NFT scams. Fraudsters will always find ways to adapt their techniques to new and upcoming technologies.

All decentralised activity takes place on the blockchain, and although some users prefer to have full control over their digital assets without intermediaries, there are other factors to consider to avoid being a victim of crypto fraud. Especially because blockchain technologies aren’t regulated. If crypto assets are lost, there are gone forever.

The main reason is due to the lack of having a central entity that traditional banks have, and therefore they aren’t protected by organizations like the FCA or FSCS in the UK or FTC in the USA.

Ways to prevent crypto fraud

The golden rule when it comes to crypto fraud and scams is if users have to question themselves twice about it then it’s worth avoiding it. So, the best way for now until there are stronger fraud prevention methods in place, is to create awareness about the dangers around DeFi if there isn’t knowledge about the vulnerabilities which users face daily in the world of crypto and DeFi.

Users should not trust strangers on social media channels. If someone reaches out offering to help, they should think twice before believing them. Fraudsters often ask for ‘investment’ payments in cryptocurrency. They even offer to help to set up a crypto wallet too, for those that don’t have one.

Avoiding unknown links or attachments which have been received via email, text message or on social media. Fraudsters trick people by sending a malicious attachment which contains malware that will instantly be downloaded on the device to steal data, users must be particularly careful with excel attachments.

This is a tactic that is often used on platforms like Discord to get people interested in upcoming NFT projects. Phishing emails or text messages also contain legit-looking links which will also steal data.

User must only invest in projects that have a proven roadmap and years or development or that have founders that have been in the crypto space for a long time and have good reputation.

Having enough knowledge about DeFi and crypto assets before investing or managing any crypto elements is key, to make sure to take a smart and careful approach when investing.

Key findings

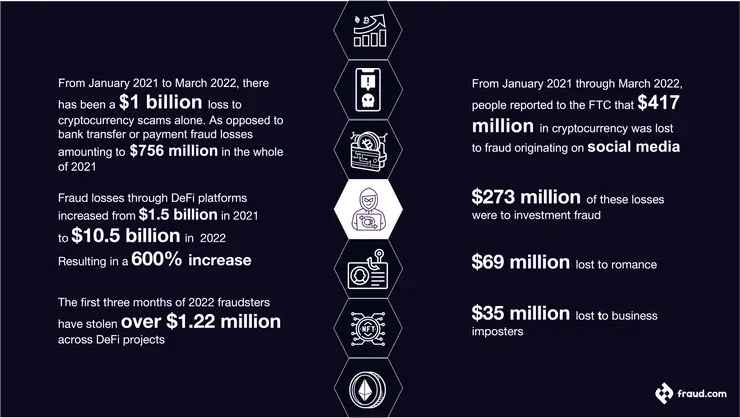

- From January 2021 to March 2022, there has been a $1 billion loss to cryptocurrency scams alone. As opposed to bank transfer or payment fraud losses amounting to $756 million in the whole of 2021.

- Fraud losses through DeFi platforms increased from $1.5 billion in 2021 to $10.5 billion in 2022. Resulting in a 600% increase.

- From January 2021 through March 2022, people reported to the FTC that $417 million in cryptocurrency was lost to fraud originating on social media. $273 million of these losses were to investment fraud, $69 million lost to romance and $35 million lost to business imposters.

- The first three months of 2022 fraudsters have stolen over $1.22 million across DeFi projects.

Crypto Fraud Prevention with Strong Identity Verification

The crypto and DeFi sector is still considered new and innovative, but regulations around fraud detection and prevention are evolving, mainly to prevent money laundering and identity theft. The use of fake and stolen identities to take over someone’s account and steal their crypto assets is a growing concern.

As interest for crypto assets increases, organisations should also increase their safety when it comes to verifying the identity of their users. Equally, it is very important to authenticate users to ensure that it is them re-accessing their account and not a fraudster.

This can be achieved with powerful and advanced facial recognition and biometric liveness detection. This is to prevent fraudsters from easily accessing and controlling a user’s assets if their data is compromised. This can happen through account takeover, phishing scams, malicious attachments, or any of the other many ways fraudsters steal data.

The safety of the users’ assets should always be of priority, this can be achieved by having strong fraud detection and prevention systems in place to protect the customers and their data. However, if a fraudster accesses their assets and funds, this can be prevented if there are stronger KYC procedures in place to verify and authenticate the real customer and instead allow the fraudster to slide through this dangerous and fragile gap.

The attraction to DeFi and crypto assets is spreading fast, thus there is still plenty of room for growth in this area. Therefore organisations must be competent to keep up with fraudsters’ attacks, as they are the first to strike and adapt to changes in the financial world. Crypto exchanges and other DeFi organisations or projects should always consider the risks which users may face as they are expected to manage and protect their assets themselves and are not protected, regulated or guarded by any entity.

How can we help with Udentify?

Udentify ID Verification and Face Authentication from Fraud.com enables you to verify and authenticate the real users to filter out the fraudsters or imposters. Tested by iBeta level 1 and level 2 for Presentation Attack Detection (PAD).

With 99.9% accuracy, our identity proofing and authentication is a frictionless way to guard against the threat of deepfake technology.

Say ‘bye’ to the fraudsters and ‘hello’ to your real live customers, and most importantly; build trust so they stay!

Learn more about Udentify