Fraudsters are constantly evolving, but so are the tools to stop them. An effective Anti-Money Laundering (AML) risk assessment is your first line of defense, helping financial institutions, businesses, and compliance teams detect, prevent, and report suspicious activity before it escalates.

In this guide, we’ll break down what an AML risk assessment is, how it uncovers fraud, and the step-by-step process to build one that works. Whether you’re in banking, fintech, or corporate compliance, this is your playbook for staying ahead of financial crime.

Table of Contents

ToggleWhat is an AML risk assessment?

An AML risk assessment is a systematic review of how vulnerable your business is to money laundering and fraud. This is not just a compliance checkbox, it’s a strategic tool that identifies weak spots in your operations, customer base, and transactions before criminals exploit them.

Regulators like the Financial Action Task Force (FATF) and FinCEN require these assessments, but the real value lies in stopping fraud before it happens. Without it, you’re in the dark, which is precisely what money launderers desire.

Key components of an effective AML risk assessment

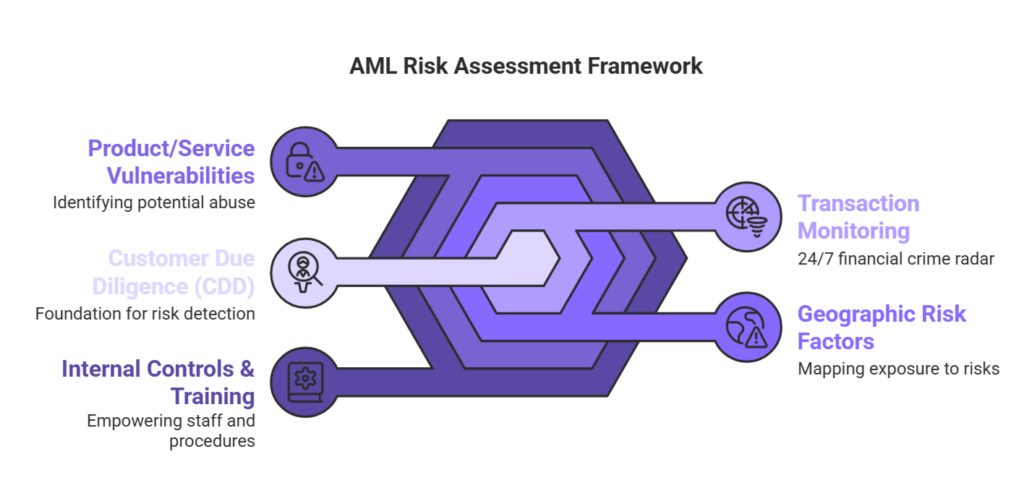

An AML risk assessment is only as strong as its weakest link. To proactively prevent money laundering and terrorist financing, build a strategy that goes beyond documentation and weaves seamlessly into your AML compliance program. Embedding these five critical components into your framework helps protect the financial system while maintaining trust in your customer relationships.

1. Customer Due Diligence (CDD) – The foundation of financial crime risk detection: Effective CDD extends far beyond collecting ID documents. It’s a dynamic process, essential for uncovering money laundering activities and assessing financial crime risk. This involves verifying identities, identifying beneficial ownership, and continuously monitoring for suspicious behaviour. High-risk customers, such as PEPs, high-cash businesses, and clients from high-risk regions, require enhanced due diligence. Skipping this step or treating it as a one-off onboarding formality opens the door to money laundering and terrorist financing.

2. Transaction monitoring – Your 24/7 AML radar: With criminal networks growing more sophisticated, detecting suspicious activity requires more than static thresholds. Advanced transaction monitoring tools, especially those integrated with fraud orchestration platforms, use behavioural analytics and AI to detect irregularities like structuring, rapid fund movements, or hidden account linkages. A well-structured system supports timely Suspicious Activity Reports (SARs) and aligns with global AML/CFT standards to uncover activity including laundering schemes that would otherwise go unnoticed.

3. Geographic risk factors – Understanding jurisdictional exposure: Money laundering often exploits weak oversight in specific regions. A strong risk-based approach incorporates country-level assessments tied to FATF (Financial Action Task Force) guidance and sanctions lists. But don’t stop there, look at transaction patterns, cross-border fund flows, IP addresses, and digital proxies to reveal hidden jurisdictional risks. High-risk geographies require closer scrutiny and elevated controls under your AML regulations.

4. Product and service vulnerabilities – Securing entry points: Every financial product presents potential entry points for illicit funds. Your AML risk assessment should evaluate each product for vulnerabilities, including prepaid cards, correspondent banking, trade finance, and crypto-related services like mixers and NFTs. Assess how customers use products and identify how they could misuse them to obscure illicit transactions. Continuous reviews are essential as new offerings enter the market and criminals adapt their techniques.

5. Internal controls and training – Building a culture of compliance: Technology is only as effective as the people behind it. A strong AML program ensures that staff understand internal policies, identify suspicious conduct, and escalate concerns appropriately. Training should cover red flags in customer behaviour, regulatory expectations under AML/CFT, and how to handle and file SARs. Frequent internal audits and a safe environment for whistleblowers reinforce your internal defence mechanisms.

These elements don’t function in isolation, they form a connected defence mechanism against financial crime. Weakness in one area creates blind spots across the entire program. The most effective AML risk assessments are not static documents, they evolve in tandem with emerging threats, evolving AML regulations, and the expectations of bodies like FATF. In a landscape where change is constant, complacency isn’t an option.

How AML risk assessments detect and prevent fraud

The early warning system: AML risk assessments act as early warning systems against financial crime. Rather than reacting to fraud after the fact, they create multiple layers of detection that help prevent it entirely. The best programs combine analytics and human insight to catch anomalies that traditional systems miss.

Transaction monitoring: Transaction monitoring is central to fraud detection. Modern tools analyse not just amounts, but the speed, frequency, and context of transfers, spotting red flags like structuring or transfers between unrelated parties. By understanding normal behaviour for each customer, these systems quickly flag anything unusual.

Customer risk profiling: Risk profiling adds a tailored layer of defence. It assigns dynamic risk ratings that adapt as new data emerges. Indicators like links to PEPs, cash-heavy businesses, or mismatched financial activity help identify high-risk clients more effectively than a one-size-fits-all approach.

Geographic analysis: Geographic insight adds depth to detection. It tracks more than just sanctioned countries, flagging secrecy havens, risky transaction routes, and inconsistencies between claimed locations and actual activity.

Behavioural analytics: Behavioural analytics capture what rules-based systems often miss. Changes in login patterns, transaction timing, or small “test” transfers can reveal early signs of account takeovers or internal threats.

The power of integration: The strength of AML assessments lies in integration. When profiling, monitoring, geography, and behaviour work together, they create a powerful, layered defence that not only detects fraud, but deters it.

Understanding regulatory complexity

Navigating today’s regulatory environment requires both vigilance and strategic foresight. As financial crimes grow more sophisticated, global regulators continue to strengthen frameworks like GDPR, PSD2, and AML directives – each with its own compliance requirements and enforcement timelines. Organizations must now balance two critical objectives: maintaining operational flexibility while implementing ironclad compliance controls.

The most effective compliance strategies go beyond minimum requirements. They incorporate regulatory intelligence into core business processes, ensuring that fraud prevention systems automatically adapt to new mandates. This proactive approach transforms compliance from a cost center into a value driver – reducing fraud losses while building customer confidence through demonstrable security measures.

Three key principles define successful regulatory navigation:

- Continuous monitoring of evolving requirements across jurisdictions

- Embedded compliance in all customer-facing processes

- Audit-ready documentation that demonstrates real-time adherence

Financial institutions that master regulatory complexity don’t just avoid penalties – they gain a strategic advantage. By aligning fraud prevention with compliance objectives, they create more resilient operations while positioning themselves as trusted partners in the financial ecosystem. The regulatory landscape will continue evolving, but organizations with integrated, intelligence-driven compliance frameworks will remain ahead of both criminals and regulators.

How to be prepared for changing requirements

In fraud prevention, change is the only certainty and in the fast-paced world of fraud prevention and detection, agility isn’t just an advantage, it’s a necessity. As regulations evolve to counter emerging threats and technologies, organisations must stay ready to adapt swiftly and seamlessly. Here’s how to stay ahead of these changes:

- Stay informed and engaged: Keep up to date with upcoming regulatory changes by subscribing to industry newsletters, joining professional forums, and engaging directly with regulatory bodies. Attending conferences and webinars also offers valuable insights and helps you anticipate the direction of fraud prevention policies.

- Invest in flexible technology: Choose adaptable, scalable technology that can evolve with compliance demands. Fraud orchestration platforms, for example, enable quick integration of new requirements without disrupting day-to-day operations. Opt for systems that support configurable workflows to respond efficiently to legislative updates.

- Foster a culture of compliance: Create an environment where compliance is a shared responsibility. Equip teams with regular training and awareness programmes to reinforce the importance of regulatory adherence. Promote open communication so teams feel confident discussing regulatory impact and preparedness.

- Conduct regular audits and assessments: Use periodic audits and risk assessments to uncover potential compliance gaps and proactively address them. These reviews provide a clear picture of your current position and highlight areas for improvement. Incorporate findings into your broader fraud prevention strategy to maintain a robust compliance posture.

- Collaborate with legal and compliance experts: Work closely with legal advisors and compliance professionals to navigate complex regulations. Their guidance can help interpret legal nuances and support smooth implementation of required changes, ensuring your response is both timely and accurate.

- Use proactive scenario planning: Map out possible regulatory developments and assess their operational impact through scenario planning. Develop contingency strategies to help organisations pivot quickly when changes occur, minimising disruption and maximising responsiveness.

- Implement continuous monitoring: Put systems in place to monitor compliance in real time. Automated tools can detect early signs of misalignment with regulations and trigger immediate corrective actions. This ensures you remain aligned with both existing and evolving requirements.

By embedding these strategies into your operations, your organisation can stay resilient and competitive in a constantly changing regulatory environment. Proactive preparation not only reduces risk but also reinforces your reputation as a trusted and compliant partner.

A unified risk assessment approach across multiple risk areas

In today’s hyper-connected world, fraud prevention and identity verification don’t operate in silos, and neither should risk management. As threats increasingly span across domains, a fragmented approach leaves organisations exposed. To effectively mitigate evolving risks, organisations need a unified risk assessment strategy that brings together insights from all corners of the business. This cohesive approach strengthens overall security while streamlining operations.

Build an integrated risk framework: Start by establishing a risk framework that consolidates different risk management functions into a single, integrated structure. Breaking down operational silos enables teams to assess how risks, ranging from fraud and cyber threats to compliance and operations, interact and amplify each other. This holistic perspective allows for more strategic and accurate risk mitigation.

Enhance risk assessment with collaborative intelligence: Pulling data from across departments, such as compliance, IT, finance, and operations, enriches risk assessments and exposes hidden vulnerabilities. Encouraging cross-functional collaboration helps identify patterns and interdependencies that isolated teams might overlook, leading to more informed and proactive responses.

Apply holistic risk analysis: Look beyond individual risk types and evaluate how incidents in one area could impact others. For instance, a fraud event could trigger reputational damage, regulatory scrutiny, or financial loss. By understanding these ripple effects, organisations can prioritise effectively and direct resources to where they’re needed most.

Leverage fraud orchestration technology: Sophisticated fraud orchestration platforms play a vital role in unified risk assessment. These solutions consolidate data from multiple risk areas, offering a single, real-time view of your organisation’s threat landscape. With built-in analytics and automation, they empower teams to identify risks quickly, coordinate responses across departments, and ensure compliance without disrupting operations.

Standardise policies and controls across risk areas: Consistency is key to effective risk management. Aligning policies and controls across departments ensures uniform application of mitigation strategies and simplifies compliance efforts. Standardised frameworks help address a range of threats simultaneously, enhancing overall security and reducing redundancies.

Adopt dynamic risk monitoring: The risk landscape doesn’t stand still, your monitoring systems shouldn’t either. Implement adaptive tools that continuously scan for anomalies, regulatory changes, or new threat vectors. Real-time alerts and dashboards enable swift action, helping you stay ahead of risk before it escalates.

Communicate risk insights effectively: Clear, accessible reporting is essential for unified risk management. Develop comprehensive communication channels that deliver insights to stakeholders at every level, from frontline teams to executive leadership. Transparent, timely updates build a risk-aware culture and support confident decision-making.

By adopting a unified risk assessment approach supported by fraud orchestration and collaborative intelligence, organisations can stay resilient in the face of complex and evolving threats. This strategy not only enhances protection but also improves efficiency, enabling sustainable growth and long-term trust with stakeholders.

Building a robust framework for AML risk assessment

As financial crime grows more complex, AML compliance remains vital to protecting your organisation’s operations and reputation. A strong AML risk assessment framework helps you identify, evaluate, and reduce risk with precision. Here’s how to build one that works:

1. Identify and classify risk: Start by mapping out where risks lie, by customer type, products, services, and geographic exposure. Pay close attention to high-risk areas like PEPs and jurisdictions with weak AML controls.

2. Collect and analyse data: Use internal records and external sources, such as sanctions lists and watchlists, to gather data. Apply analytics to detect unusual patterns and identify suspicious behaviour before it escalates.

3. Evaluate and score risk: Score each risk based on its likelihood and potential impact. This structured approach makes it easier to compare risks and prioritise efforts where they matter most.

4. Design mitigation strategies: Tailor controls to match risk levels. Implement enhanced due diligence for high-risk clients, strengthen transaction monitoring, and keep staff trained on spotting red flags.

5. Monitor and adapt continuously: Deploy tools that track activity in real time and review your risk framework regularly. Stay ahead by adjusting to new threats, business changes, and shifting regulations.

6. Report transparently: Document your risk processes and decisions thoroughly. Clear reporting satisfies regulators and keeps leadership aligned on compliance priorities.

7. Train and involve stakeholders: Make AML compliance everyone’s responsibility. Deliver regular training and engage staff at all levels to build a culture that recognises and acts on financial crime risk.

A well-executed framework helps prevent money laundering and terrorist financing, strengthening compliance and boosting trust in your business.

Anti-Money Laundering Risk Assessment FAQs

| Question | Answer |

|---|---|

| What is an AML risk assessment? | It’s a systematic evaluation of how vulnerable an organisation is to money laundering, helping detect and mitigate risks before exploitation occurs. |

| Why is an AML risk assessment important? | It prevents financial crime, ensures regulatory compliance, and protects your business from reputational and financial damage. |

| How often should AML risk assessments be updated? | At least annually, or whenever there are significant changes in products, regulations, customer base, or geographic operations. |

| Who is responsible for AML risk assessments? | Typically, compliance officers or AML teams, though all staff should be aware and contribute to identifying suspicious activity. |

| What are high-risk indicators in AML? | Politically Exposed Persons (PEPs), high-cash businesses, unusual transaction patterns, high-risk jurisdictions, and anonymous ownership structures. |

| Can technology enhance AML risk assessments? | Yes. Advanced tools like behavioural analytics, AI-powered transaction monitoring, and fraud orchestration platforms improve detection and response. |

| What’s the role of customer due diligence (CDD)? | CDD helps verify identities, assess risk levels, and monitor customer behaviour to prevent onboarding of high-risk individuals. |

| How does transaction monitoring support AML efforts? | It detects suspicious activity in real time by analysing patterns, frequency, amounts, and irregularities across transactions. |

| What happens if a business lacks a proper AML risk assessment? | It faces regulatory fines, reputational loss, increased fraud risk, and potential criminal liability. |

| How do AML risk assessments align with global regulations? | They follow standards from bodies like FATF and FinCEN, ensuring businesses meet local and international AML/CFT compliance obligations. |