Fraud poses a constant threat to businesses, regardless of their size. Protecting your business and customers from fraudulent activities is crucial for safeguarding your assets, reputation, and overall operations. In this article, we delve into the intricate world of fraud prevention, what it entails, why it’s essential, and how it shields your business.

The aim of this article is to provide a comprehensive understanding of fraud prevention and its significance in business. We’ll explore various fraud risks businesses face and the measures they can implement to mitigate them effectively. From anti-fraud policies to cutting-edge software solutions leveraging artificial intelligence and machine learning, we’ll uncover the tools and strategies that empower businesses to detect and thwart fraudulent threats.

Fraudulent activities come in various forms, ranging from all types of financial fraud such as account takeover fraud to identity theft, phishing, and card skimming. These schemes can lead to significant financial losses and irreparable damage to a company’s reputation. However, with a robust fraud prevention approach in place, businesses can proactively protect themselves and their customers.

By implementing anti-fraud policies and procedures, companies can establish a framework for identifying and addressing potential threats. Furthermore, leveraging advanced technologies such as artificial intelligence and machine learning enables businesses to analyze vast amounts of data, detecting patterns and anomalies indicative of fraudulent activity.

Join us as we unravel the intricacies of fraud prevention and discover how it serves as a vital shield against financial losses and reputational damage. Together, we’ll explore practical strategies and best practices to fortify your business against the ever-evolving landscape of fraudulent threats.

Table of Contents

ToggleWhat is fraud prevention?

Fraud prevention is the process or set of activities implemented to prevent, deter, detect, and resolve fraudulent incidents. The goal of fraud prevention is to reduce the incidence of fraud and related consequences. Prevention strategies may focus on deterring potential fraudsters, detecting fraudulent activity, or resolving incidents of fraud.

Prevention strategies are often implemented as part of a larger risk management program. Individuals, businesses, or organisations may take prevention measures. When implemented correctly, prevention strategies can save businesses and organizations time and money. Fraud prevention for all types of organizations is an important part of maintaining a secure and efficient operation.

Why is fraud prevention so important?

Fraud prevention stands as a cornerstone of business security, playing a pivotal role in safeguarding the integrity and stability of your operations. Here, we delve into the critical importance of fraud prevention and its profound impact on businesses of all sizes:

- Protecting assets and finances: Fraud prevention is vital for safeguarding a company’s financial resources and assets. By implementing robust measures, businesses can mitigate the risk of financial losses due to fraudulent activities.

- Safeguarding reputation: A company’s reputation is its most valuable asset. Effective fraud prevention not only protects against financial harm but also preserves trust and credibility among customers, partners, and stakeholders.

- Ensuring operational continuity: Fraudulent activities can disrupt normal business operations, leading to chaos and operational setbacks. Prioritizing fraud prevention ensures smooth workflow and minimizes the risk of disruptions.

- Upholding ethical standards: Fraud prevention is a testament to a company’s commitment to integrity and ethical conduct. By proactively combating fraud, businesses demonstrate transparency, accountability, and adherence to ethical principles.

- Compliance with legal and regulatory requirements: Compliance with laws and regulations is imperative for business sustainability. Effective fraud prevention measures ensure adherence to legal requirements, mitigating the risk of regulatory fines and penalties.

- Preserving customer trust and loyalty: Customer trust and loyalty are essential for business success. Fraud prevention efforts reassure customers of the company’s reliability and integrity, strengthening relationships and enhancing long-term loyalty.

- Protecting intellectual property and confidential information: Intellectual property and confidential information are valuable assets that must be safeguarded. Fraud prevention measures help prevent unauthorized access and misuse of sensitive data, preserving the company’s competitive edge.

- Maintaining competitive advantage: Fraud prevention contributes to maintaining a competitive edge in the market. By ensuring security and reliability, businesses differentiate themselves from competitors, attracting customers and enhancing market positioning.

In summary, fraud prevention is indispensable for businesses seeking to protect their assets and finances, safeguard their reputation, ensure operational continuity, uphold ethical standards, comply with legal requirements, preserve customer trust and loyalty, protect intellectual property and confidential information, and maintain a competitive advantage. By investing in robust fraud prevention measures, businesses can fortify their defenses against potential threats, fostering long-term success and resilience in an increasingly complex business landscape.

Main elements of fraud prevention

Fraud prevention is essential for protecting organizations from financial losses and reputational harm. While specific elements of fraud prevention may vary across industries, the following three elements exemplify recommendations outlined by the Anti-Fraud Program by the Arkansas Department of Inspector General:

- Creating and maintaining a culture of honesty: Establishing a culture rooted in honesty and high ethics is fundamental. This involves instilling strong values and fostering an environment where ethical behavior is encouraged.

- Evaluating risks and implementing controls: Identifying and assessing potential fraud risks is crucial. Implementing processes and controls to mitigate these risks helps safeguard the organization against fraudulent activities.

- Developing an appropriate oversight process: Establishing oversight measures ensures effective monitoring and enforcement of fraud prevention efforts. This involves implementing mechanisms to oversee employee activities, evaluate control effectiveness, and address vulnerabilities proactively.

This framework provides a clear example of elements recommended for an effective anti-fraud program. While organizations may adapt these elements to suit their specific needs and industry requirements, the outlined framework serves as a valuable foundation for fraud prevention efforts.

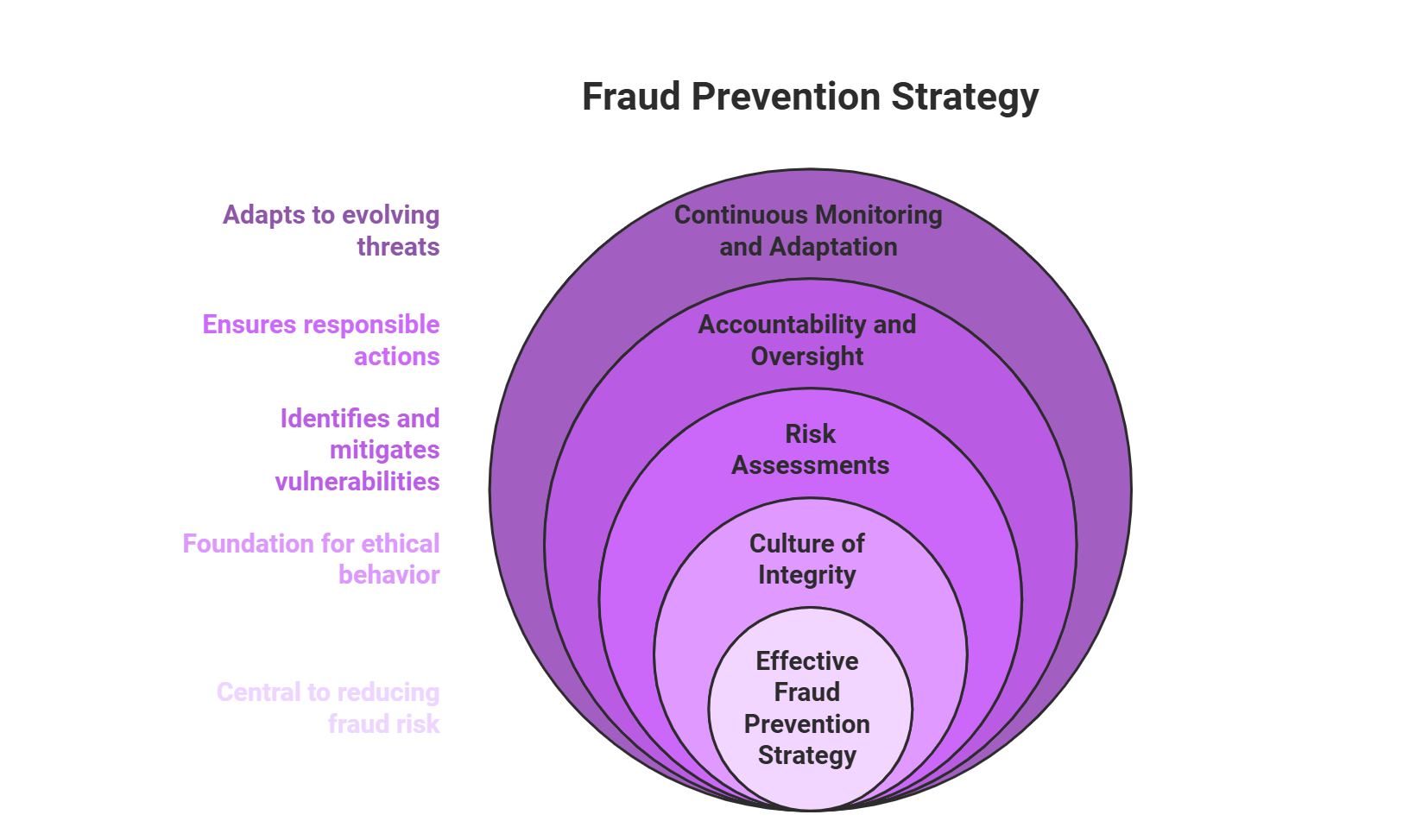

As discussed fraud prevention stands as a critical pillar in safeguarding the integrity and stability of any organization. Effectively combatting fraud requires the establishment of a comprehensive anti-fraud program, encompassing various key elements.

Fraud prevention is a cornerstone of organizational integrity and security, demanding a multi-faceted approach that addresses various critical components.

In the following sections, we will delve into an extended version of this program, providing additional insights and recommendations that organizations can adopt to enhance their fraud prevention strategies. Let’s delve deeper into these main components of fraud prevention to understand their significance and impact on organizational security:

- Fostering a culture of integrity and transparency: Establishing and nurturing a culture of integrity and transparency is paramount for effective fraud prevention. This foundational element entails instilling core values that prioritize ethical conduct, honesty, and accountability throughout the organization. Leaders must set the tone at the top by exemplifying these values in their actions and decisions, thereby creating a culture where ethical behavior is not only expected but celebrated. Key aspects of fostering a culture of integrity include:

- Clear communication of organizational values and expectations.

- Regular training and education on ethical standards and fraud awareness.

- Creating a supportive and inclusive workplace environment that encourages open communication and collaboration.

- Recognizing and rewarding ethical behavior and contributions to fraud prevention efforts.

- Risk assessment and mitigation strategies: Conducting thorough risk assessments is essential for identifying potential fraud risks and vulnerabilities within the organization. This process involves analyzing internal and external factors that could expose the organization to fraudulent activities, such as operational processes, regulatory requirements, and industry trends. By understanding these risks, organizations can develop targeted mitigation strategies to minimize the likelihood and impact of fraudulent incidents. Key aspects of risk assessment and mitigation strategies include:

- Identifying specific fraud risks and scenarios relevant to the organization’s operations.

- Implementing controls and procedures to address identified risks, such as segregation of duties, access controls, and transaction monitoring.

- Regular monitoring and evaluation of control effectiveness to adapt to evolving fraud threats and changing business environments.

- Incorporating fraud prevention considerations into strategic planning and decision-making processes.

- Promoting accountability and establishing effective oversight: Promoting accountability and providing avenues for reporting suspected fraud are essential elements of a robust fraud prevention program. Employees should be empowered to raise concerns about potential fraudulent activities without fear of retaliation, fostering a culture of accountability and transparency. Key aspects of promoting accountability and whistleblower protections include:

- Establishing clear reporting channels and procedures for reporting suspected fraud or misconduct.

- Ensuring confidentiality and protection for whistleblowers to encourage reporting of legitimate concerns.

- Conducting thorough investigations of reported incidents and taking appropriate disciplinary action against perpetrators.

- Educating employees about their rights and responsibilities regarding fraud reporting and whistleblower protections.

- Continuous monitoring and adaptation: Effective fraud prevention requires ongoing monitoring and adaptation to address emerging threats and vulnerabilities. Organizations should implement mechanisms for continuous monitoring of internal controls, fraud detection systems, and employee behavior to detect and respond to potential fraud incidents in a timely manner. Key aspects of continuous monitoring and adaptation include:

- Regular reviews and updates of fraud prevention policies, procedures, and controls based on changing risks and regulatory requirements.

- Leveraging technology and data analytics to enhance fraud detection capabilities and identify anomalous behavior patterns.

- Conducting periodic assessments of the effectiveness of fraud prevention measures and making adjustments as needed to improve efficacy.

- Engaging stakeholders across the organization in fraud prevention efforts and promoting a culture of vigilance and awareness.

By incorporating these essential components into their fraud prevention efforts, organizations can strengthen their defenses against fraudulent activities and protect their assets, reputation, and stakeholders’ trust. At Fraud.com, we are committed to helping organizations develop and implement effective fraud prevention strategies tailored to their unique needs and challenges.

Types of fraud

There are various types of fraud that affect businesses and individuals, but some of the most common types include:

1. Accounting fraud

This occurs when someone deliberately falsifies financial statements in order to mislead investors or other interested parties. This can be done in a number of ways, such as overstating or understating revenue, inflating or deflating assets, or hiding expenses.

2. Bank fraud

This is committed when someone tries to illegally obtain money from a bank or financial institution. This can be done through a number of methods, such as creating false documents, forging signatures, or using stolen account information.

3. Credit card fraud

It occurs when someone uses a stolen or counterfeit credit card to make unauthorized charges. This can be done by making online purchases, by phone, or in person.

4. Identity theft

Identity theft occurs when someone uses another person’s personal information, such as their name, Social Security number, or credit card number, without their permission. This can be done in order to open new accounts, make purchases, or take out loans in the other person’s name.

5. Insurance fraud

This occurs when someone deliberately lies or withholds information in order to obtain insurance benefits or coverage that they would not otherwise be entitled to. This can be done by exaggerating the value of damages, faking injuries, or staging accidents.

6. Investment fraud

This occurs when someone uses false or misleading information to convince people to invest in a company or product. This can be done through a number of means, such as false advertising, misrepresentation of facts, or insider trading.

Prevention is important for all businesses and individuals. By being aware of the different types of fraud and taking steps to prevent it, you can protect yourself and your business from financial loss. The types listed above are just a few of the most common, so it’s important to stay up-to-date on the latest fraudulent trends and to have a solid prevention plan in place.

Fraud prevention requirements

In the ever-evolving landscape of fraud, organisations face increasingly sophisticated threats that can compromise financial integrity and reputations. To combat these risks effectively, implementing robust internal controls and fraud prevention measures is paramount. Here, we delve into ten essential fraud prevention requirements recommended by the NYS Office of Mental Health’s Bureau of Audit, offering a comprehensive framework to mitigate the threat of fraudulent activities.

These guidelines provide a comprehensive framework applicable across various sectors, offering essential measures to mitigate the risk of financial misconduct and fraud. However, organisations should always consider industry-specific regulations and local compliance standards when developing their fraud prevention strategies to ensure alignment with legal and regulatory requirements.

- Implement checks and balances: Establishing a system of checks and balances is fundamental to preventing financial misconduct. By ensuring that no single individual has unchecked control over all aspects of financial transactions, organisations can mitigate the risk of fraudulent activity going undetected.

- Require authorisation for transactions: Mandating that purchases, payroll, and disbursements undergo thorough authorisation by designated personnel adds an extra layer of security against unauthorised expenditures. This measure enhances accountability and transparency in financial operations.

- Segregate duties: Segregating handling functions, such as receipt and deposit, from record-keeping functions is crucial for preventing potential collusion and fraudulent manipulation of financial records. This separation of duties minimises the opportunity for fraud to occur unnoticed.

- Separate purchasing and payables: Maintaining a clear separation between purchasing and payables functions helps safeguard against conflicts of interest and ensures that transactions are processed impartially. This separation enhances oversight and accountability in financial transactions.

- Dual authorisation for checks: Requiring dual authorisation for checks—whereby the same individual is not authorised to both write and sign checks—reduces the risk of unauthorised disbursements and enhances control over outgoing payments.

- Mail handling procedures: Implementing robust procedures for handling incoming mail, such as endorsing checks upon receipt and maintaining a detailed log before depositing them, strengthens oversight of incoming payments and reduces the risk of misappropriation.

- Supervisory approval for time sheets: Requiring supervisory approval for employees’ time sheets before processing payroll serves as a crucial control mechanism to verify the accuracy of reported hours worked, mitigating the risk of payroll fraud.

- Independent review of work: In situations where duties cannot be fully segregated, conducting independent reviews of work by individuals not directly involved in the process adds an additional layer of oversight and helps detect potential irregularities or discrepancies.

- Vacation requirement for employees: Mandating that accounting department employees take periodic holidays not only promotes work-life balance but also acts as a deterrent against fraudulent activities that may require continuous monitoring or manipulation of records.

- Regular bank reconciliation: Performing monthly reconciliations of agency bank accounts and ensuring that these reconciliations are conducted by independent personnel or subject to supervisory review helps identify discrepancies and irregularities in financial transactions promptly.

While different industries and countries may have varying fraud prevention requirements tailored to their specific contexts and regulatory frameworks, the ten requirements outlined here serve as a clear example of best practices recommended by the NYS Office of Mental Health’s Bureau of Audit.

By adhering to these fraud prevention requirements, organisations can fortify their internal controls, mitigate risks, and safeguard against the ever-present threat of fraudulent activities. Embracing a proactive approach to fraud prevention is essential for protecting financial assets, preserving reputations, and maintaining trust among stakeholders.

Who is responsible for fraud prevention?

Fraud prevention is a multifaceted task that typically involves various stakeholders within an organization and according to the organization and structural form or decision making processes, there may be one particular party or multiple parties directly responsible for fraud prevention. However, from a multifaceted perspective, many parties within an organisation are to be responsible somehow for procedures involved in fraud prevention as it is such a key element within every organization. Here are the key players commonly involved:

- Executive leadership: The ultimate responsibility for fraud prevention often rests with the executive leadership, including the CEO, CFO, and other C-suite members. They set the tone at the top and establish a culture of integrity and ethical behavior throughout the organization.

- Board of directors: Boards play a crucial role in overseeing fraud prevention efforts. They are responsible for establishing policies and procedures, ensuring adequate resources are allocated to fraud prevention activities, and monitoring the effectiveness of the organization’s anti-fraud programs.

- Compliance and legal departments: These departments are tasked with ensuring that the organization complies with relevant laws and regulations related to fraud prevention. They develop and enforce policies and procedures designed to mitigate fraud risks and ensure legal compliance.

- Internal audit: Internal audit functions independently within the organization to assess the adequacy and effectiveness of internal controls, including those related to fraud prevention. They conduct audits and investigations to identify weaknesses in controls and recommend improvements.

- Risk management: The risk management function identifies, assesses, and manages risks across the organization, including fraud risks. They work closely with other departments to implement controls and mitigation strategies to address these risks.

- Finance and accounting departments: These departments are responsible for maintaining accurate financial records and implementing controls to prevent fraudulent activities such as embezzlement, misappropriation of funds, and financial statement fraud.

- Human Resources: HR plays a role in fraud prevention by implementing background checks, screening employees, providing ethics training, and maintaining a whistleblowing hotline to report suspected fraudulent activities.

- IT security: Given the increasing prevalence of cyber and financial fraud, IT security teams play a critical role in preventing fraud by implementing cybersecurity measures to protect against data breaches, identity theft, and other cybercrimes.

- Employees: All employees have a responsibility to prevent fraud by adhering to company policies and procedures, reporting suspicious activities, and maintaining integrity in their own conduct.

- External partners: External auditors, legal counsel, law enforcement agencies, and other external partners may also be involved in fraud prevention efforts, particularly in investigating and prosecuting cases of fraud.

Effective fraud prevention requires a coordinated effort among these stakeholders, with each playing a distinct role in safeguarding the organization against fraudulent activities.

Who uses fraud prevention?

There are many types of fraud, so there are many types of people and organisations that use prevention services. Some common examples include:

● Credit card companies

● Banks

● Online retailers

● E-commerce businesses

● Government agencies

● Law enforcement

Data breaches are can target any type of organisation. The Equifax data breach, for example, affected over 140 million people and exposed sensitive information like Social Security numbers and birthdates. Transactions that are made with stolen credit cards or that are related to identity theft are also common types of fraud.

The best way to protect against fraudulent activity is to be aware of the different types of fraud and to take steps to prevent it, but fraudulent incidents can vary from business to business. Some businesses are prone to higher volumes of fraud than others, and some may have more sophisticated prevention systems in place, while others may not.

Big data and machine learning are becoming increasingly important in the fight against fraud, as they can help to identify patterns and anomalies that may indicate fraudulent threats. Credit card companies, banks, and online retailers are all using these technologies to help prevent fraud, as it’s the future of prevention.

Fraud prevention examples

Fraud prevention requires organizations to adopt a variety of strategies to protect against fraudulent activities. While these strategies may vary depending on the organization and industry, here are some general examples of effective fraud prevention measures:

- Risk assessment: Regularly assess risks to identify potential fraud areas and develop targeted prevention strategies.

- Employee training: Educate employees on fraud risks, signs of fraud, and how to report suspicious activity.

- Whistleblower programs: Implement confidential reporting systems to encourage employees to report fraud without fear of retaliation.

- Technology for monitoring: Use fraud detection software and data analytics to identify unusual behavior or transactions.

- Background checks: Perform background checks on employees, especially in high-risk roles, to prevent hiring individuals with a history of fraud.

- Vendor due diligence: Vet vendors and third-party partners to reduce the risk of fraud from external sources.

- Segregation of duties: Avoid concentrating key tasks in one person’s hands to minimize fraud opportunities.

- Audits and monitoring: Conduct regular audits and ongoing monitoring to detect and address fraud early.

- Anti-fraud policies: Establish clear anti-fraud policies and procedures to guide employees in recognizing and reporting fraud.

- Ethical culture: Foster a culture of integrity and transparency to reduce the likelihood of fraud.

These measures, when consistently applied, can help organizations reduce fraud risk and protect their assets.

How does fraud prevention work?

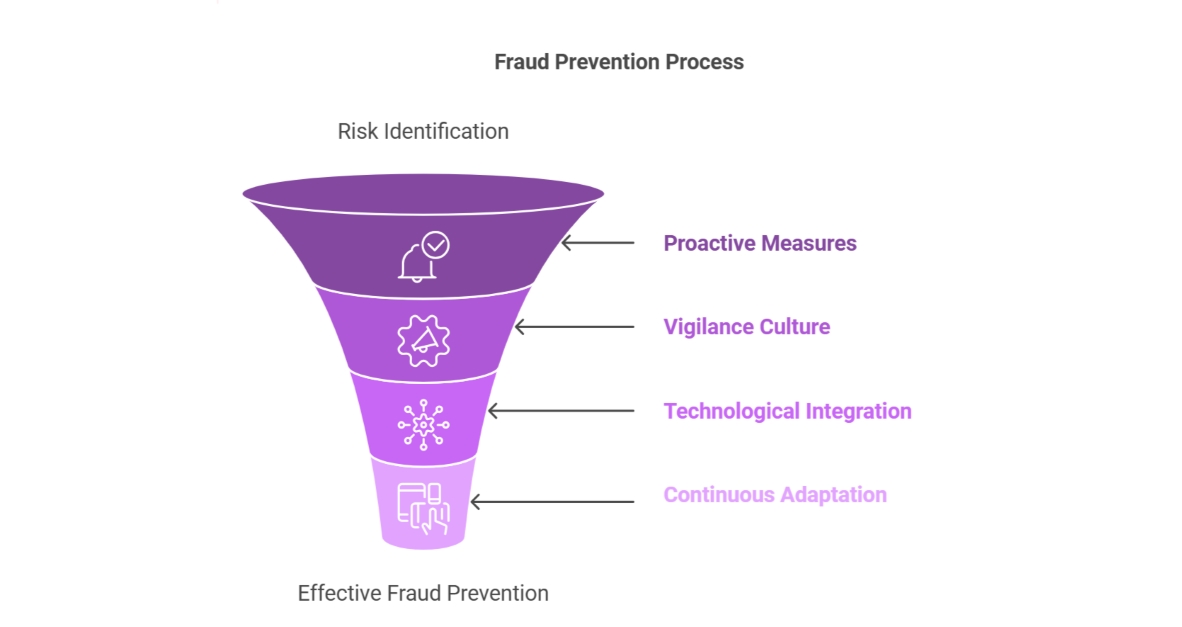

Fraud prevention is a systematic process that involves several key steps aimed at identifying, assessing, and mitigating potential threats before they cause significant harm. It works by integrating people, technology, and processes to protect an organization’s assets and reputation. Here are the key steps involved:

- Understanding the risks: The first step is to identify the various risks an organization faces, including vulnerabilities in operations, financial processes, and customer interactions. By analyzing past incidents and studying industry trends, organizations can better understand the types of fraud they are likely to encounter.

- Establishing a proactive approach: Fraud prevention is about preventing fraud before it happens, not reacting after the fact. This involves putting in place continuous monitoring systems that flag potential issues early and clear protocols for addressing suspicious activities.

- Building a culture of vigilance: Fostering a culture of vigilance is crucial. This means educating employees, partners, and stakeholders about fraud prevention, their role in it, and how to report suspicious activities. A vigilant workforce acts as the first line of defense against fraud.

- Integrating technology and automation: As fraud techniques evolve, leveraging technology is essential. Automated systems that monitor transactions in real time, detect anomalies, and alert relevant personnel can help prevent fraud while reducing human error and speeding up responses.

- Implementing continuous monitoring and adaptation: Fraud prevention is an ongoing process. After implementing preventive measures, continuous monitoring ensures they remain effective. This involves regularly reviewing fraud detection systems, updating risk assessments, and adapting strategies to stay ahead of new threats.

These steps form the foundation for an effective fraud prevention strategy, paving the way for specific techniques to detect and prevent fraud in almost real-time.

How fraud prevention works – Prevention techniques

There are many ways to prevent fraud, but most involve technology, processes, and people. Here are some of the most common prevention techniques:

1. Use data to your advantage

Data is your best friend when it comes to prevention. By analysing past fraudulent patterns, you can develop better models to detect and prevent future fraudulent threats.

2. Implement anomaly detection

Anomaly detection is a method of identifying unusual behavior. It can detect fraud by flagging transactions that are outside the norm.

3. Know Your Customer (KYC)

It’s essential to know who your customers are and what their normal behavior looks like. This way, you can more easily identify unusual behavior indicative of fraud.

4. User authentication

Authentication is the process of verifying that someone is who they claim to be. It can be used to prevent fraud by ensuring that only authorized users have access to sensitive information.

5. Prevent fraud with Artificial Intelligence (AI)

Artificial intelligence (AI) can be used to detect and prevent fraud. AI can be used to analyse data to identify patterns and anomalies indicative of fraudulent behaviour. AI can also be used to authenticate users and verify their identities.

6. Prevent fraud with Machine Learning (ML)

Machine learning (ML) is teaching computers to learn from data. ML can be used to detect and prevent fraudulent threats by identifying patterns and anomalies in data. ML can also be used to authenticate users and verify their identity. There are many machine learning algorithms, including supervised and unsupervised learning.

How to minimize fraud?

Minimizing fraud needs a proactive and multi-faceted strategy that blends preventive measures with a culture of security and accountability within an organization. By embracing the following comprehensive strategies, businesses can fortify their defenses against fraud, mitigating the risk of financial losses:

| Strategies to minimize fraud (for organizations) | Explanation |

| 1. Develop and enforce comprehensive fraud prevention policies | Establish robust policies and procedures that delineate expected employee conduct, identify potential fraud risks, and implement controls to deter fraudulent activities. |

| 2. Perform regular fraud risk assessments | Conduct periodic assessments to identify vulnerabilities in systems, processes, and controls, enabling proactive remediation and targeted prevention efforts. |

| 3. Provide ongoing employee training | Empower employees with knowledge about prevalent fraud schemes, red flags, and reporting protocols. Well-informed and vigilant staff are pivotal in early fraud detection and prevention. |

| 4. Enhance cybersecurity measures | Bolster defenses against cyber threats through the adoption of advanced technologies like encryption, multi-factor authentication, and intrusion detection systems, coupled with regular security audits. |

| 5. Implement real-time transaction monitoring | Deploy monitoring systems to detect anomalies and suspicious activities, enabling swift intervention to prevent fraudulent transactions from escalating. |

| 6. Adopt robust identity verification processes | Employ stringent identity verification methods such as biometrics and KYC procedures to authenticate customer identities and thwart identity theft and account takeover fraud. |

| 7. Foster a culture of reporting and whistleblowing | Cultivate transparency and accountability by encouraging employees to report suspected fraud through confidential channels. Establishing whistleblower policies facilitates early detection and intervention. |

| 8. Conduct thorough vendor due diligence | Evaluate the integrity and security practices of vendors and partners, implementing stringent due diligence protocols and oversight mechanisms to minimize external fraud risks. |

| 9. Stay vigilant against emerging threats | Remain abreast of evolving fraud tactics and cybersecurity threats by engaging with industry associations, attending training sessions, and leveraging relevant fraud prevention resources. |

| 10. Continuously evaluate and enhance controls | Regularly review and improve fraud prevention measures, internal controls, and security protocols based on feedback, emerging risks, and lessons learned. |

| Strategies to minimize fraud (for users/individuals) | Explanation |

| 1. Protect your personal information and online accounts | Safeguard your personal information and use strong, unique passwords for online accounts to prevent unauthorized access and reduce the risk of identity theft and fraud. |

| 2. Stay vigilant against phishing and unsolicited requests | Be cautious of phishing attempts and unsolicited requests for personal or financial information, especially from unfamiliar sources, to avoid falling victim to fraudulent schemes. |

| 3. Secure your devices and enable Two-Factor Authentication or MFA | Keep your devices secure with antivirus software and regular updates, and enable two-factor authentication or Multi-Factor Authentication (MFA) wherever possible to add an extra layer of security to your accounts. |

| 4. Monitor financial statements and review privacy settings | Regularly review your bank and credit card statements for unauthorized charges, and adjust privacy settings on social media accounts to control access to personal information. |

| 5. Be wary of public Wi-Fi and verify website legitimacy | Avoid using public Wi-Fi for sensitive activities and verify the legitimacy of websites and links before sharing personal information online to prevent data interception and fraud. |

| 6. Educate yourself on common scams and fraud tactics | Stay informed about common scams and fraudulent schemes targeting individuals to recognize and avoid falling victim to fraudulent tactics. |

| 7. Shred sensitive documents and protect physical documents | Shred sensitive physical documents containing personal information before discarding them and store important documents securely to prevent identity theft and unauthorized access. |

| 8. Limit sharing personal information online and be skeptical | Be cautious about sharing personal information online and responding to unsolicited requests, especially if they seem too good to be true, to minimize the risk of identity theft and fraud. |

| 9. Keep software and devices updated and use security features | Regularly update your devices and software with the latest security patches and use security features such as two-factor authentication and biometric authentication to enhance account security. |

| 10. Report suspicious activity and verify sources | Report any suspicious activity or attempts at fraud to the appropriate authorities and verify the legitimacy of sources before providing personal or financial information. |

By integrating these strategies into their operations, organizations can fortify their resilience against fraud risks, safeguard their assets and reputation, and foster trust among customers and stakeholders. Minimizing fraud requires a collaborative and proactive approach, embedding fraud prevention as a cornerstone of business operations and risk management.

Common fraud attacks

There are many types of fraud attacks, but some of the most common are:

Malware

This is a type of software that is designed to damage or disable computers. It can be used to steal information, or to take control of a computer in order to extort money from the owner.

Malware is often spread through email attachments or by visiting malicious websites. It can also be installed on a computer without the owner’s knowledge, for example through a USB drive that has been infected with malware. There are many different types of malware, including viruses, Trojan horses, spyware, and ransomware.

Identity theft

This is when someone steals your personal information in order to commit fraud. They may use your name and address to apply for credit cards or loans in your name, or to impersonate you online.

Those who commit identity theft can obtain your personal information in a number of ways, including stealing your wallet or purse, going through your trash, or hacking into your computer or email account. Most of the time, you will not know that your identity has been stolen until you receive a bill for something you did not purchase, or you are contacted by a collection agency. This can be a very stressful and difficult situation to deal with.

Phishing

Phishing is a type of online fraud where criminals send emails or texts impersonating a company in order to trick you into giving them your personal information. They may say there is a problem with your account or that you need to update your information, and they will provide a link to a fake website that looks legitimate. Once you enter your information on this website, the criminals will have access to it.

Fraudulent websites can also be used to infect your computer with malware, which can give the criminals access to your files and passwords. It is important to be very careful when clicking on links in emails, and to only enter your personal information on websites that you trust. Using your judgement and being cautious online can help you avoid becoming a victim of phishing.

Ransomware

Ransomware is easy to spot if you’re paying attention, but if you’re not, you could easily become a victim.

Ransomware is a type of malware that encrypts your files and holds them hostage until you pay a ransom. It’s a growing problem, and there have been some high-profile victims, including the city of Atlanta and the Hollywood Presbyterian Medical Center.

There are a few things to look out for that can help you spot a ransomware attack:

1. Unexpected emails or messages from strangers demanding payment.

2. Your computer suddenly locking up or becoming unresponsive.

3. A message appearing on your screen demanding payment in order to decrypt your files.

If you see any of these signs, it’s important to act quickly. Do not pay the ransom, as this will only encourage the attacker and there is no guarantee that your files will be decrypted. Instead, contact a professional to help you remove the malware and restore your files.

Account Take Over

Another type of fraud can be account take over fraud (ATO). This is where a fraudster will gain access to a user’s account and use it to commit fraudulent transactions. This can be done by stealing the user’s login credentials or using social engineering to trick the user into giving them access to their account.

To prevent ATO, users should use strong and unique passwords for their accounts. They should also enable two-factor authentication if it is available. Machine learning can also be used to detect ATO.

Fraud detection and prevention using AI and ML

Fraud detection and prevention is a critical part of any business, and AI and ML can play a key role in helping organizations detect and prevent fraudulent behaviour. AI and ML can help organizations identify patterns of behavior that may indicate fraud, and they can also help organizations automatically flag suspicious activity for further investigation.

Additionally, AI and ML can help organizations develop predictive models that can identify which individuals or groups are more likely to commit fraud, and these models can be used to target prevention and detection efforts.

Artificial intelligence and machine learning are also being used to develop new methods of fraud detection and prevention. For example, AI-based systems are being used to analyse large data sets to identify patterns of behaviour that may indicate fraudulent activities.

Plus, machine learning algorithms are being used to develop predictive models that can identify which individuals or groups are more likely to commit fraud. These models can be used to target prevention and detection efforts.

By using AI and ML to help detect and prevent fraudulent activities, organisations can save time and money, and they can also improve their customer experience. Additionally, AI and ML can help organizations protect their reputation by helping to identify and prevent fraud before it occurs.

How can AI prevention tools help prevent fraud?

AI prevention tools can help prevent fraud by analysing data to identify fraudulent behaviour and alerting businesses to potential risks. AI tools can also help businesses automate prevention processes, such as fraud detection, prevention, and response.

When used correctly, AI fraud prevention tools can be highly effective in reducing fraud and protecting businesses from financial losses. There are a number of AI prevention tools available on the market, and businesses should select the tool that best meets their needs. aiReflex is a leading AI fraud prevention tool that offer a variety of features to help businesses prevent fraud.

Fraud prevention activities

Fraud prevention activities are essential in detecting and thwarting potential financial scams and fraudulent activities. Through robust data collection and analysis, fraud monitoring systems can identify suspicious changes within account profiles, beneficiary additions, payee modifications, and other actions that may trigger fraud alerts. These activities involve monitoring various data points, such as:

- Online and mobile banking sessions: Tracking user sessions on online and mobile banking platforms to detect any unusual behavior, login attempts, or unauthorized access.

- Device registrations: Monitoring devices used for accessing accounts to flag any unrecognized or new devices that may indicate fraudulent activity.

- IP addresses: Analyzing IP addresses associated with account logins to identify potentially fraudulent access from suspicious locations or multiple logins from different IPs.

- Customer activities and financial behaviour: Examining customer transaction histories, spending patterns, and account interactions to identify anomalies or deviations from normal behavior that may indicate fraudulent activity.

- Transaction monitoring: Implementing real-time transaction monitoring systems to identify and prevent fraudulent transactions based on predefined patterns and rules.

- Identity verification processes: Employing robust identity verification methods, such as biometric authentication or two-factor authentication, to ensure the legitimacy of account users and prevent unauthorized access.

- Cybersecurity measures: Enhancing cybersecurity protocols, including encryption technologies, firewalls, and intrusion detection systems, to protect sensitive data and prevent cyber threats.

- Customer education initiatives: Conducting awareness campaigns and training programs to educate customers about common fraud schemes, phishing tactics, and how to recognize and avoid potential scams.

- Collaboration with law enforcement: Establishing partnerships with law enforcement agencies and regulatory authorities to report suspected fraud incidents, investigate fraudulent activities, and take legal action against perpetrators.

- Continuous improvement: Continuously evaluating and enhancing fraud prevention strategies, monitoring tools, and security measures to stay ahead of evolving fraud tactics and protect against emerging threats in the financial landscape.

By implementing these comprehensive fraud prevention activities, organizations can strengthen their defenses against fraud, safeguard their customers’ assets, and uphold trust in their financial services. Vigilance, proactive monitoring, and a multi-faceted approach to fraud prevention are crucial for maintaining the integrity and security of financial transactions in today’s digital age.

Fraud prevention information

The FDIC emphasizes the importance of cybersecurity in preventing fraud, highlighting that inadequate cybersecurity measures can result in stolen identities and financial loss. Scammers often aim to steal both money and personal information, making it essential for individuals to be vigilant and informed about potential threats. To safeguard against fraud, the FDIC recommends the following steps:

- Avoid opening emails from unfamiliar senders and verify the legitimacy of emails before clicking on any links.

- Be cautious of deceptive website addresses and ensure the security of personal information before sharing.

- Stay informed about cybersecurity threats and scams by following alerts from the Cybersecurity and Infrastructure Security Agency (CISA).

- Use strong passwords and keep software and operating systems updated to protect against cyber threats.

- Be aware of trending scams such as money mules, online dating scams, impostor scams, mortgage and foreclosure scams, and ransomware attacks.

By following these preventive measures and remaining alert to potential scams, individuals can enhance their cybersecurity defenses and mitigate the risk of falling victim to fraud.

Fraud prevention is crucial to protect yourself and your business from potential scams and fraudulent activities. By following these tips and best practices, you can minimize the risk of falling victim to fraudulent schemes:

- Be cautious of unsolicited emails or messages requesting sensitive information such as passwords, account numbers, or personal details. Legitimate organizations will never ask for this information via email.

- Verify the legitimacy of any website before making online purchases or providing personal information. Look for secure connections (https://) and trust seals from reputable authorities.

- Use strong, unique passwords for all your online accounts and enable two-factor authentication whenever possible to add an extra layer of security.

- Monitor your financial statements and accounts regularly for any unauthorized transactions or suspicious activity.

- Be wary of offers that seem too good to be true, such as lottery winnings or unsolicited investment opportunities. Trust your instincts and do thorough research before taking any actions.

- Educate yourself and your team on common fraud tactics and how to recognize and report them. Stay up-to-date on the latest scam alerts and security trends.

- Be cautious when sharing personal information on social media platforms. Avoid posting sensitive details such as your full name, address, phone number, or financial information that could be used for identity theft or phishing scams.

- Keep your devices and software updated with the latest security patches and antivirus protections to prevent malware and other cyber threats from compromising your data.

- Avoid clicking on suspicious links or downloading attachments from unknown sources, as they may contain malware or phishing attempts to steal your information.

- Consider using a virtual private network (VPN) when accessing public Wi-Fi networks to encrypt your connection and protect your data from potential eavesdropping or hacking attempts.

By incorporating these additional fraud prevention measures into your online habits and security practices, you can further enhance your protection against fraudsters and cybercriminals. Stay informed, stay alert, and stay proactive in safeguarding your digital footprint and financial well-being.

By staying vigilant and following these fraud prevention tips, you can help safeguard your sensitive information and prevent potential financial losses. Remember, it’s always better to be safe than sorry when it comes to protecting yourself against fraud.

Frequently Asked Questions (FAQs) about fraud prevention

In this section, we address a series of frequently asked questions (FAQs) concerning fraud prevention. While the accompanying article delves into these topics with comprehensive detail, the table below offers a concise summary of some of the pivotal inquiries surrounding fraud prevention.

Whether you’re seeking foundational knowledge or a quick reference guide, this compilation serves to provide insights into the key aspects of safeguarding against fraudulent activities within organizations and systems. Explore these questions to gain a fundamental understanding of fraud prevention strategies, detection methods, legal considerations, and more:

| FAQs about fraud prevention | Answer |

|---|---|

| 1. What is fraud prevention? | Fraud prevention refers to the set of measures and strategies designed to identify, deter, and mitigate fraudulent activities within an organization or system. |

| 2. Why is fraud prevention important? | Fraud prevention is crucial for maintaining trust, protecting financial stability, and preserving the integrity of an organization or system. |

| 3. What are common types of fraud? | Common types of fraud include identity theft, payment card fraud, phishing scams, insider fraud, procurement fraud, and financial statement fraud. |

| 4. How can I detect fraud? | Fraud detection involves recognizing suspicious patterns, behaviors, or anomalies that may indicate fraudulent activity. |

| 5. What are some preventive measures against fraud? | Preventive measures against fraud include implementing robust internal controls, conducting thorough background checks on employees and vendors, providing fraud awareness training, enforcing segregation of duties, securing sensitive information through encryption and access controls, and staying updated on emerging fraud trends and techniques. |

| 6. How can I create a fraud prevention plan for my business? | Developing a fraud prevention plan involves assessing potential risks, establishing clear policies and procedures, assigning accountability for fraud prevention efforts, fostering a culture of ethics and integrity, regularly reviewing and updating preventive measures, and collaborating with relevant stakeholders such as legal advisors and law enforcement agencies. |

| 7. What should I do if I suspect fraud? | If you suspect fraud, it’s essential to act promptly by gathering evidence, documenting your concerns, and reporting the suspected fraud to the appropriate authorities or internal channels designated for handling such matters. |

| 8. How can technology help in fraud prevention? | Technology plays a vital role in fraud prevention by providing tools for real-time monitoring, data analytics, biometric authentication, fraud detection algorithms, and encryption techniques to safeguard sensitive information. |

| 9. What are the legal implications of fraud prevention? | Compliance with relevant laws and regulations, such as the Sarbanes-Oxley Act, the Foreign Corrupt Practices Act, and data protection laws, is essential in fraud prevention efforts. |

| 10. How can I stay informed about the latest fraud trends and best practices? | Staying informed about the latest fraud trends and best practices involves actively engaging with industry associations, attending conferences, participating in training programs, subscribing to relevant publications, and networking with professionals in the field of fraud prevention and risk management. Additionally, leveraging online resources and seeking guidance from experts can help you stay updated on emerging threats and effective prevention strategies. |

Our fraud prevention solution – aiReflex

aiReflex is a powerful AI fraud prevention tool that analyses data to identify fraudulent behaviuor and alert businesses to potential risks. aiReflex offers a wide range of features to help businesses automate fraud prevention processes, including fraud detection, prevention, and response.

aiReflex is a leading fraud prevention solution that adopts predictive analytics, AI and machine learning to transform fraud prevention measures across various domains. Here’s how aiReflex contributes to comprehensive fraud prevention:

- Comprehensive risk assessment: aiReflex conducts thorough risk assessments by analyzing multiple parameters, including user behavior, transaction history, and other relevant data points. This comprehensive approach enables the early detection of potential fraud attempts.

- Real-time fraud detection: Leveraging advanced machine learning algorithms, aiReflex continuously monitors transactions and activities, promptly flagging suspicious behavior for further investigation. This real-time detection capability helps organizations stay ahead of emerging fraud threats.

- Adaptive fraud models: aiReflex employs adaptive fraud models that evolve over time to adapt to changing fraud patterns and tactics. By learning from historical data and adjusting its algorithms accordingly, aiReflex ensures optimal fraud detection accuracy and effectiveness.

- Integration with existing systems: aiReflex seamlessly integrates with existing fraud management systems and workflows, minimizing disruption to business operations. This flexibility enables organizations to enhance their fraud prevention capabilities without overhauling their existing infrastructure.

- Customizable rule sets: With aiReflex, organizations can define and customize rule sets based on their specific fraud prevention requirements and risk tolerance levels. This tailored approach allows for fine-tuning of fraud prevention strategies to align with organizational goals and priorities.

By harnessing the power of predictive analytics and machine learning, aiReflex empowers organizations to proactively identify and mitigate fraud risks, safeguarding their assets, reputation, and customer trust.