Know Your Customer onboarding is a crucial process for businesses seeking to ensure compliance and protect against fraud. As regulations tighten and cyber threats evolve, companies need efficient, secure methods to verify customer identities while providing a seamless user experience. This article explores how optimizing KYC onboarding can enhance both security and customer satisfaction, helping businesses meet compliance standards while preventing fraud.

Table of Contents

ToggleWhat is KYC?

Know Your Customer (KYC) is a regulatory standard designed to help financial institutions prevent financial crimes such as money laundering, identity theft, and terrorism financing. It involves a set of KYC procedures that validate a customer’s identity and verify their customer data before allowing access to financial services.

Central to these procedures is the collection and validation of critical personal information like name, date of birth, government-issued ID, and proof of address such as a utility bill. KYC is not just about compliance, it’s a strategic risk-control mechanism that safeguards both organisations and customers.

What is KYC onboarding?

The KYC onboarding process refers to the first step in a customer’s journey with a financial service provider. It includes customer identification, identity verification, risk assessment, and customer due diligence (CDD). At this stage, businesses gather and verify essential KYC data to assess whether a potential client is genuine and poses any regulatory or financial risk. A streamlined onboarding experience helps detect high-risk customers from the outset, enabling firms to stay compliant with evolving AML regulations and deliver a smooth customer experience.

How does KYC onboarding work?

The KYC onboarding process follows a structured series of steps designed to ensure compliance, security, and efficiency. It begins when the customer submits key information, including customer data, a government-issued ID, and a utility bill for address verification. Businesses then perform identity verification through a combination of automated tools and manual reviews to confirm legitimacy.

The system cross-checks this data against global anti-money laundering (AML) watchlists and sanctions databases. A thorough risk assessment determines whether the individual qualifies as a high-risk customer, shaping the level of customer due diligence (CDD) required. Once the customer passes these initial checks, institutions implement ongoing monitoring to detect suspicious activity throughout the customer’s lifecycle, ensuring continuous compliance with evolving AML regulations.

Why is KYC onboarding important?

A robust KYC onboarding process is a cornerstone of regulatory compliance and defence against financial crimes. By rigorously verifying identities and performing early-stage risk assessments, businesses can prevent onboarding bad actors while enhancing trust with legitimate clients. Efficient KYC measures also improve the customer experience by reducing friction and delays. For financial institutions, this means increased security, operational integrity, and reputational resilience, all while remaining compliant with AML regulations.

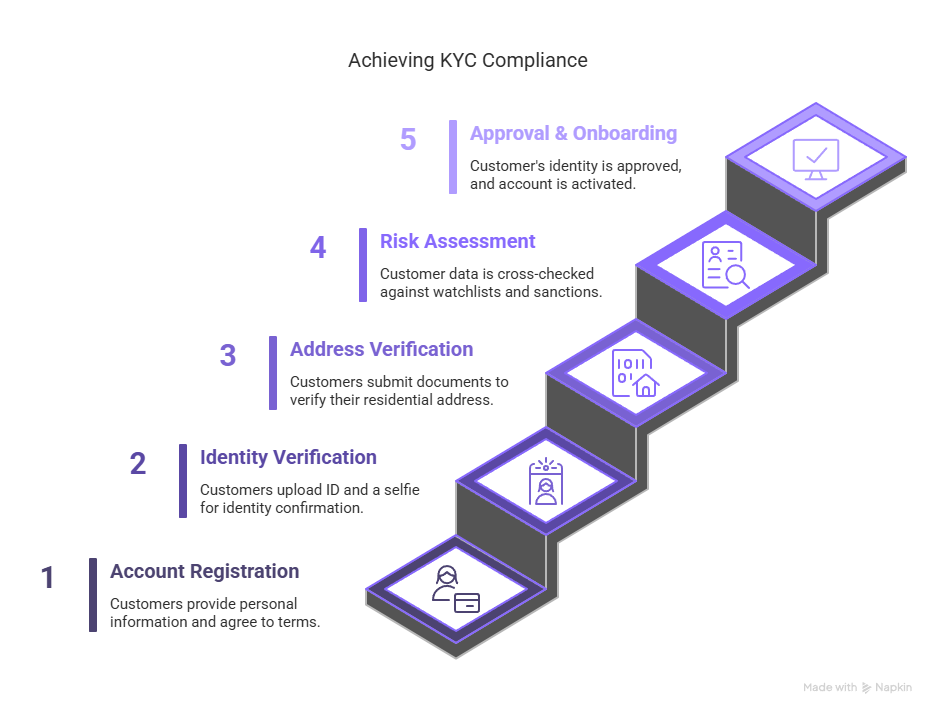

Key 5 steps in KYC onboarding

1. Account registration: Customers enter essential personal information, including full name, date of birth, and contact details, and agree to the platform’s terms and conditions. This step initiates the KYC onboarding process and lays the foundation for regulatory compliance.

2. Identity verification: Customers upload a government-issued ID (e.g., passport or driver’s licence) and may be prompted to take a selfie or live photo. Advanced biometric comparison tools validate the identity in real-time, strengthening defences against identity theft and fraud.

3. Address verification: Customers submit proof of address, such as a utility bill or bank statement, to confirm their residential location. This ensures geographic compliance and supports accurate customer identification.

4. Risk assessment & background check: The system cross-verifies customer data against global sanctions lists, watchlists, and politically exposed persons (PEP) databases. This risk assessment step identifies high-risk customers and detects possible involvement in financial crimes, forming the basis for tailored customer due diligence (CDD).

5. Approval & onboarding: Once all verifications are complete, the platform either approves or denies the customer. Approved users gain access to services, while ongoing monitoring begins to ensure continuous compliance with AML regulations. Businesses may also implement periodic re-KYC to reflect changes in customer risk profiles or regulatory updates.

These five steps not only ensure alignment with local and international anti-money laundering (AML) standards but also safeguard financial institutions from fraud, identity abuse, and regulatory breaches, enhancing the overall onboarding experience.

How do KYC onboarding requirements vary around the world?

The scope and execution of the KYC onboarding process vary widely across jurisdictions. In the European Union, AML regulations are driven by frameworks such as the Anti-Money Laundering Directive (AMLD), alongside stringent data privacy rules enforced under GDPR. In the United States, the Bank Secrecy Act (BSA) requires detailed KYC procedures, enhanced customer identification, and real-time transaction monitoring to prevent financial crimes.

Meanwhile, many emerging markets are shifting toward digital-first regulations, though they often lack cohesive and standardised compliance frameworks. For global financial institutions, adapting KYC onboarding protocols to meet regional requirements is crucial to stay compliant, avoid penalties, and ensure seamless cross-border operations.

Challenges of KYC onboarding

KYC onboarding plays a vital role in fraud prevention and regulatory compliance, but it also introduces several strategic and operational challenges for financial institutions.

- Data privacy and compliance: Financial institutions must constantly balance thorough identity verification with evolving global data privacy laws, such as GDPR.

- Operational costs: Manual processes, third-party vendor tools, and specialised compliance teams drive up the cost of maintaining an effective KYC onboarding process.

- Regulatory complexity: Businesses must frequently adjust their KYC procedures to comply with inconsistent AML regulations and changing reporting obligations across different regions.

- Legacy system integration: Institutions often struggle to integrate modern KYC solutions with outdated IT infrastructure, which slows operations and increases compliance risks.

- Customer friction: Overly complicated onboarding steps frustrate users, hurt the overall customer experience, and lead to higher abandonment rates.

Benefits of KYC onboarding

When deployed strategically, effective KYC onboarding not only resolves these challenges but also strengthens compliance, efficiency, and customer loyalty.

- Advanced data security: Businesses safeguard sensitive KYC data, including government-issued ID, biometric inputs, and customer data, through robust encryption and secure storage.

- Cost efficiency through automation: Organisations reduce human error and accelerate identity verification by automating key stages with AI and ML, cutting down compliance costs significantly.

- Global adaptability: Flexible platforms adapt to regional compliance standards, ensuring smooth customer due diligence (CDD) and alignment with global AML regulations.

- Smooth tech integration: Companies easily incorporate new onboarding technologies into their existing systems, enabling scalable operations without workflow disruption.

- Improved customer experience: A streamlined, secure, and user-friendly onboarding experience fosters trust from the start, driving higher customer retention and long-term brand loyalty.

The role of AI and automation in streamlining KYC onboarding

Artificial Intelligence (AI) and automation are transforming the KYC onboarding process, empowering businesses to perform faster, more accurate identity verification. These technologies eliminate manual tasks, reduce errors, and enhance overall efficiency, allowing companies to onboard customers seamlessly while complying with regulations.

AI-driven systems process vast amounts of data swiftly, identifying patterns and anomalies that signal potential fraud. Machine Learning (ML) algorithms continuously learn from historical data, improving their accuracy in spotting discrepancies or suspicious behavior. This immediate evaluation is essential for detecting and preventing fraud at the start of the onboarding process.

Automation complements AI by handling repetitive tasks like document collection, verification, data entry, and cross-referencing with databases and sanctions lists. With Robotic Process Automation (RPA), businesses cut onboarding time significantly, ensuring a frictionless experience for customers while maintaining rigorous compliance.

AI and automation also play a crucial role in compliance management. These technologies seamlessly integrate the latest regulatory requirements into the onboarding process, reducing the risk of non-compliance and costly fines. This allows businesses to focus human resources on higher-value activities, freeing them from routine checks.

How KYC onboarding prevents identity theft and fraud

KYC onboarding is a critical defense against identity theft and fraud. By verifying identities and assessing potential risks upfront, businesses prevent fraudsters from accessing services or engaging in financial transactions.

During KYC onboarding, businesses cross-reference customer data against trusted databases, including government records and international sanctions lists. This thorough vetting process identifies discrepancies or suspicious indicators that suggest fraudulent intent. Using advanced authentication methods, such as biometric verification and two-factor authentication (2FA), further secures the process, making it harder for fraudsters to impersonate legitimate clients.

Continuous monitoring of customer activities and transactions allows companies to detect suspicious behavior early, preventing larger risks from emerging. This proactive approach identifies potential fraud before it escalates into a serious issue.

Furthermore, KYC onboarding aligns with global Anti-Money Laundering (AML) standards, acting as a key measure for spotting illegal financial activities. By blocking fraudsters and malicious actors, businesses safeguard their assets and contribute to a secure financial ecosystem.

The future of KYC onboarding: Key trends to watch

As digital transformation accelerates, the future of KYC onboarding will be shaped by cutting-edge innovations. Here are some key trends:

- Enhanced biometric verification: Biometric methods such as facial recognition and fingerprint scanning will become even more widely adopted, providing secure and seamless verification for customers.

- Blockchain integration: Blockchain technology offers a decentralized, immutable ledger for storing and sharing customer data, enhancing transparency and reducing the risk of data tampering. This approach fosters trust across parties involved in the verification process.

- RegTech solutions: Regulatory Technology (RegTech) is gaining momentum, delivering automated, real-time compliance solutions that adapt swiftly to regulatory changes. These solutions ensure businesses stay aligned with evolving legal standards, minimizing the risk of non-compliance.

- Personalized onboarding experiences: As AI and data analytics enhance customer insights, businesses will deliver more personalized onboarding experiences, improving satisfaction while maintaining robust identity verification processes.

- Zero-Knowledge Proofs (ZKPs): This emerging technology allows customers to verify their identity or specific information without directly sharing the data, enhancing privacy and streamlining the verification process.

- Global KYC harmonization: Efforts to standardize KYC regulations worldwide will simplify cross-border transactions, ensuring consistent compliance practices and reducing complexity for multinational enterprises.

By adopting these innovations, businesses will enhance their KYC onboarding systems, boosting efficiency, strengthening fraud prevention, and ensuring ongoing compliance in an ever-evolving regulatory landscape.

How Udentify enhances KYC onboarding

Udentify simplifies KYC onboarding with fast, secure, and compliant identity verification. Using AI-powered facial recognition, liveness detection, and document checks, Udentify verifies users in seconds, reducing onboarding time and preventing fraud.

Key benefits include:

- Real-time identity verification with biometric accuracy

- Automated onboarding workflows that cut manual work

- Compliance with global KYC and AML regulations

- Fraud prevention through advanced spoof detection

- Smooth user experience on any device

With Udentify, businesses can onboard customers confidently, stay compliant, and protect against identity fraud, all while delivering a seamless digital experience.

Get started with Udentify and transform your KYC onboarding.

KYC onboarding FAQ

| Question | Answer |

|---|---|

| What is KYC onboarding? | KYC onboarding is the process where businesses verify customer identities, assess risk, and collect necessary documents such as ID and proof of address to ensure regulatory compliance and prevent fraud. |

| Why is KYC onboarding important? | It is vital for preventing financial crimes, ensuring compliance with regulations, enhancing security, and improving the overall customer experience. |

| What are the key steps in KYC onboarding? | 1. Account registration 2. Identity verification 3. Address verification 4. Risk assessment & background check 5. Approval & onboarding |

| How does KYC onboarding work? | Customers provide essential data, such as ID and proof of address, which is then verified via automated and manual checks, cross-checked with global AML watchlists, and assessed for potential risks. |

| What challenges do businesses face with KYC? | Challenges include balancing data privacy laws, operational costs, regulatory complexity, legacy system integration, and customer friction due to complicated processes. |

| How does AI and automation help KYC? | AI and automation streamline the process by quickly validating identity, cross-referencing data, detecting fraud, and ensuring compliance with evolving regulations, making onboarding faster and more secure. |

| How does KYC prevent fraud and identity theft? | KYC helps detect fraudulent activity by verifying customer data, comparing it against global watchlists, and using biometric methods to ensure the person is legitimate, reducing the chance of identity theft. |

| What trends will shape the future of KYC onboarding? | Key trends include enhanced biometric verification, blockchain integration, RegTech solutions, personalized onboarding experiences, Zero-Knowledge Proofs (ZKPs), and global KYC harmonization to simplify cross-border operations. |

| How does Udentify improve KYC onboarding? | Udentify simplifies the process with AI-powered facial recognition, document checks, and real-time identity verification, ensuring faster, secure, and compliant onboarding while preventing fraud. |