Protecting financial transactions and personal data has never been more crucial in today’s digital world. Fraudsters continuously adapt, finding new ways to exploit vulnerabilities, so do the systems designed to stop them. One of the most effective safeguards is the Know Your Customer (KYC) process, which verifies identities to prevent fraud before it happens.

More than just a regulatory requirement, KYC strengthens trust between businesses and their customers, ensuring secure financial interactions. This article explores how the KYC process actively detects and prevents fraudulent activities, reinforcing security for both businesses and individuals in an increasingly digital economy.

Table of Contents

ToggleWhat is the KYC process?

The Know Your Customer process is a vital security measure that financial institutions and businesses use to verify customer identities. Its primary goal is to confirm that individuals and entities engaging in financial transactions are legitimate, reducing the risk of fraud. This involves collecting and verifying key identification documents, such as government-issued IDs, utility bills, and, increasingly, biometric data.

The KYC process begins with gathering basic customer information, which is then cross-checked against reliable data sources to ensure accuracy. Beyond initial verification, businesses also conduct ongoing monitoring to detect suspicious activity that could signal fraud. By following strict KYC protocols, companies can minimize risks related to money laundering, identity theft, and financial crimes while maintaining regulatory compliance.

More than just a compliance requirement, KYC strengthens security and transparency, fostering trust between businesses and customers. As regulations tighten and technology advances, the KYC process continues to evolve, remaining a cornerstone of fraud prevention and digital security.

How the KYC process works

The Know Your Customer (KYC) process is a structured, multi-step approach designed to verify customer identities and minimize the risk of fraud, particularly preventing money laundering and other financial crimes. Here’s how it works:

- Collecting customer information: The process begins with gathering essential details from individuals or businesses. For individuals, this includes name, address, date of birth, and contact information. For businesses, the process requires more comprehensive documentation, such as corporate records and financial statements, to verify their legitimacy. This forms the foundation of the Customer Identification Program (CIP), a key component of KYC regulations.

- Identity verification: Once the information is collected, it must be authenticated. Financial institutions use various verification methods, including government database checks, third-party validation services, and biometric authentication (such as facial recognition or fingerprint scanning). This step ensures that customers are who they claim to be and helps identify any politically exposed persons (PEPs), whose higher risk status requires additional scrutiny under KYC identity verification regulations.

- Risk assessment: After verification, businesses assess the potential risks associated with each customer. The process analyzes factors such as transaction history, geographic location, ties to high-risk industries, and associations with known politically exposed persons (PEPs) to detect potential involvement in illegal activities. This risk assessment helps identify specific risk factors that could raise concerns about money laundering or other financial crimes. Any red flags may prompt further review and investigation, in line with the Financial Crimes Enforcement Network (FinCEN) guidelines.

- Ongoing monitoring: KYC doesn’t stop at onboarding. Continuous monitoring plays a vital role in detecting suspicious behavior over time. Advanced analytics track transaction patterns, flagging inconsistencies that could indicate illegal activities or attempts to bypass regulations. Unusual activity triggers alerts for further investigation, ensuring ongoing compliance with KYC regulations.

- Regulatory compliance: Beyond fraud prevention, KYC ensures businesses remain compliant with local and international regulations, including the Patriot Act in the U.S. and other financial crimes regulations. By adhering to KYC regulations, institutions not only prevent money laundering but also avoid potential legal penalties, safeguarding their reputation and maintaining trust with regulators like FinCEN.

By implementing these steps, the KYC process strengthens financial security, reduces the risk of money laundering and other financial crimes, and fosters a transparent and trustworthy financial ecosystem.

KYC process in banking

Banks play a crucial role in preventing financial crimes, and the Know Your Customer (KYC) process helps them verify customer identities, detect fraud, and comply with regulations. As financial threats evolve, banks continuously refine their KYC practices to ensure security and transparency. Here’s how they implement KYC:

1. Customer onboarding: Banks verify customer identities as soon as they open an account. Individuals submit government-issued IDs, proof of address, and recent photographs. Businesses provide additional documents, such as incorporation certificates, business licenses, and financial statements, to confirm legitimacy.

2. Enhanced Due Diligence (EDD): For high-risk clients or large transactions, banks conduct enhanced due diligence (EDD). They perform deeper background checks, verify the source of funds, and sometimes interview clients to assess financial behavior. These measures help banks identify potential risks before approving transactions.

3. Continuous relationship monitoring: Banks don’t stop monitoring after account opening. They track transaction patterns in real-time, using advanced software to detect unusual activity. If they identify suspicious behavior, such as sudden large transfers or connections to high-risk regions, they investigate further.

4. Periodic re-verification: Customer information changes over time, so banks regularly update records to reflect new addresses, employment details, or financial standings. This ongoing verification ensures they maintain accurate risk assessments and stay ahead of potential fraud.

5. Compliance and reporting: Regulatory bodies require banks to follow anti-money laundering (AML) and counter-terrorism financing (CTF) laws. When banks detect suspicious activity, they must file Suspicious Activity Reports (SARs) with authorities, contributing to global efforts to combat financial crime.

6. Digital integration: As digital banking grows, banks increasingly rely on electronic verification, remote document submission, and digital signatures. These innovations streamline the KYC process, allowing banks to onboard customers globally while maintaining strong security measures.

By enforcing strict KYC protocols, banks protect themselves from financial and reputational risks while ensuring a secure banking environment for customers. As financial crime tactics evolve, banks continuously enhance KYC measures to stay ahead of emerging threats.

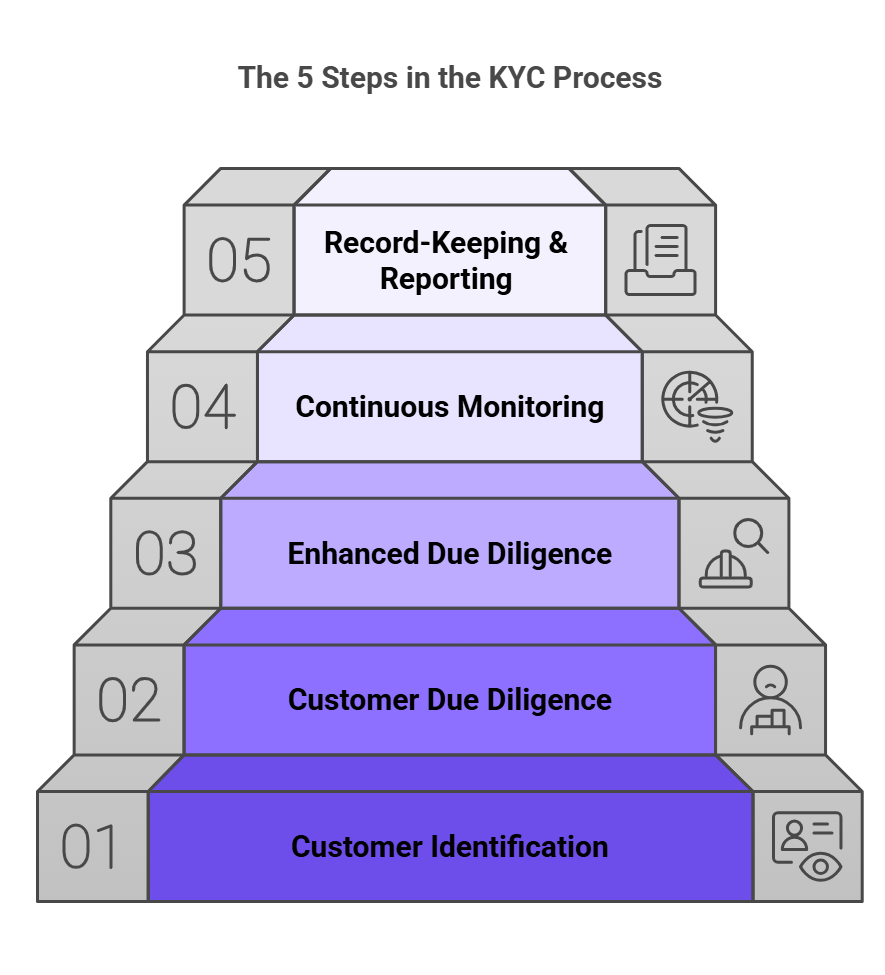

What are the 5 main steps in the KYC process?

The Know Your Customer (KYC) process is a systematic approach that businesses use to verify client identities and manage potential risks. Here’s an overview of the five key steps that make up this essential process:

Customer Identification Program (CIP)

The process starts with collecting fundamental information to verify a customer’s identity. Customers provide details such as their full name, date of birth, address, and identification numbers (e.g., Social Security or passport numbers). They must also submit physical or digital copies of identity documents to support verification.

Customer Due Diligence (CDD)

After confirming identification, businesses assess the customer’s risk profile. Customer Due Diligence examines factors like occupation, financial background, and the nature of the customer’s relationship with the institution. This assessment helps identify potential risks linked to their transactions and activities.

Enhanced Due Diligence (EDD)

Businesses conduct Enhanced Due Diligence for high-risk customers, performing a deeper review to ensure transparency. This step involves verifying the source of funds, analyzing large or complex transactions, and conducting thorough background checks to uncover potential red flags.

Continuous monitoring

The KYC process extends beyond initial verification. Businesses continuously monitor customer transactions using real-time analytics and advanced detection tools. These systems track transaction patterns, flagging any anomalies that may indicate fraud or illicit activities.

Record-keeping and reporting

Businesses maintain detailed records of customer information and interactions to ensure regulatory compliance and provide a reliable audit trail. If monitoring detects suspicious activities, businesses report them to regulatory authorities through mechanisms like suspicious activity reports (SARs).

These five steps form a strong framework for verifying customer identities, assessing risks, and ensuring compliance. The KYC process plays a crucial role in fraud prevention, security enhancement, and fostering trust in the financial system.

Why is the KYC process important?

The Know Your Customer (KYC) process is essential for securing financial transactions, ensuring compliance, and building trust. Here’s why it plays a critical role in modern financial operations:

- Preventing fraud: KYC helps stop fraud before it happens. By verifying customer identities, it reduces the risk of identity theft, financial fraud, and other criminal activities. This layer of protection safeguards both customers and businesses, ensuring secure transactions.

- Ensuring regulatory compliance: Governments worldwide enforce strict regulations to combat money laundering and terrorism financing. Financial institutions must comply with these laws to avoid hefty fines and reputational damage. KYC ensures businesses meet these legal requirements while maintaining operational integrity.

- Managing risk effectively: Not all customers pose the same level of risk. KYC allows businesses to assess each customer’s risk profile and adjust monitoring efforts accordingly. This proactive approach helps financial institutions allocate resources efficiently while maintaining stability.

- Strengthening customer trust and security: With cyber threats on the rise, customers want assurance that their personal and financial data is secure. A strong KYC process reassures them that institutions are committed to protecting their identities and funds, fostering long-term trust.

- Supporting global business operations: As financial transactions increasingly cross borders, KYC provides a standardized way to verify identities worldwide. This enables businesses to expand internationally with confidence, knowing that all parties meet security and compliance standards.

- Driving data-driven decision making: KYC isn’t just about compliance, it also provides valuable customer insights. By analyzing collected data, businesses can improve products, refine marketing strategies, and enhance customer service, ultimately driving growth and innovation.

By implementing a strong KYC process, financial institutions protect themselves from fraud, maintain compliance, and create a safer, more trustworthy financial ecosystem.

What is electronic KYC verification (eKYC)?

Electronic Know Your Customer (eKYC) verification is a digital alternative to traditional identity verification, using technology to speed up and secure the process. Instead of handling physical documents, customers submit digital IDs through online platforms or mobile apps, eliminating in-person visits and paperwork.

eKYC, identity verification, facial recognition, and digital account opening

eKYC enhances identity verification by integrating biometric authentication, such as facial recognition and fingerprint scanning, adding an extra layer of security that’s hard to forge. Automated systems verify data instantly against government and third-party databases, reducing human error and speeding up approvals.

Security is a top priority, with advanced encryption protecting sensitive data and minimizing fraud risks. Automating KYC also lowers costs, cutting the need for manual processing while allowing businesses to scale efficiently.

By adopting eKYC, financial institutions ensure compliance while offering customers a faster, more secure, and seamless verification experience. This digital shift strengthens fraud prevention and supports a more efficient financial system.

KYC compliance and regulations

Know Your Customer (KYC) compliance is essential for maintaining security and preventing financial crimes. Regulations ensure that businesses can verify customer identities, monitor transactions, and detect suspicious activities. Here’s a breakdown of key aspects of KYC compliance and regulations:

- Global regulatory frameworks: KYC compliance is shaped by international regulations designed to combat money laundering, terrorism financing, and other financial crimes. Organizations like the Financial Action Task Force (FATF) set global standards that guide local regulatory policies. Financial institutions must align with these frameworks to implement strong KYC protocols.

- Anti-Money Laundering (AML) requirements: KYC is a core component of Anti-Money Laundering (AML) laws, which require financial institutions to identify and report suspicious activities. Regulations such as the USA PATRIOT Act mandate strict KYC measures to prevent illicit transactions and ensure that institutions notify authorities about potential threats.

- Customer iOdentification Program (CIP): A key part of KYC compliance is the Customer Identification Program (CIP), which outlines the minimum information businesses must collect before opening an account. This includes verifying identities using government-issued documents and reliable data sources to prevent fraudulent access to financial services.

- Data privacy and protection: KYC regulations also emphasize safeguarding customer information. Laws like the General Data Protection Regulation (GDPR) in the European Union require financial institutions to handle personal data securely, ensuring compliance with privacy standards and minimizing the risk of data breaches.

- Regular audits and reporting: Financial institutions must conduct regular audits to ensure their KYC processes remain effective and compliant. They are also required to submit reports, such as Suspicious Activity Reports (SARs), to regulatory authorities when detecting potentially fraudulent activities.

- Consequences of non-compliance: Failure to comply with KYC and AML regulations can result in severe penalties, including hefty fines, legal action, and reputational damage. To avoid these risks, institutions must continuously update their compliance practices, invest in employee training, and adopt advanced technologies for identity verification and monitoring.

By following strict KYC regulations, financial institutions not only protect themselves from fraud but also contribute to a more secure and transparent global financial system.

How fraud.com enhances the KYC process

Fraud.com offers powerful solutions to streamline the KYC process, helping businesses prevent fraud, stay compliant, and manage risks efficiently.

Udentify: AI-Powered identity verification

Udentify enables seamless, secure identity verification through facial recognition, liveness detection, and document authentication, reducing the risk of identity fraud. It helps businesses:

- Automate identity verification for faster onboarding.

- Enhance security with biometric authentication.

- Ensure compliance with global regulations like AML and GDPR.

aiReflex: AI-Driven fraud detection

aiReflex provides real-time fraud detection using AI, helping businesses:

- Instantly identify fraudulent activity with advanced machine learning.

- Monitor transactions continuously to spot suspicious patterns early.

- Minimize false positives for more accurate threat detection.

fcase: Fraud management and orchestration

fcase centralizes fraud case management, allowing businesses to:

- Streamline investigations and respond to threats efficiently.

- Orchestrate workflows for timely fraud resolution.

- Automate compliance reporting, including SAR generation.

By combining Udentify, aiReflex, and fcase, fraud.com strengthens the KYC process, enhancing fraud prevention, compliance, and customer experience. These solutions help businesses stay ahead of threats while maintaining a secure financial environment.

KYC process FAQ

| Question | Answer |

|---|---|

| What is KYC? | KYC (Know Your Customer) is a mandatory process to verify the identity of customers to prevent fraud, money laundering, and other financial crimes. |

| Why is the KYC process necessary? | It ensures regulatory compliance, protects against identity theft, and helps build trust by confirming customer identities. |

| What documents are needed for KYC? | Typically, a government-issued ID (e.g., passport or driving licence), proof of address, and, in some cases, proof of income or business activity. |

| How long does the KYC process take? | The duration varies depending on the verification method, but digital biometric solutions can complete the process within minutes. |

| Is my data safe during the KYC process? | Yes. We use advanced encryption and comply with data protection regulations to ensure your personal information is handled securely. |

| Can I update my KYC information later? | Yes. If your details change (e.g., new address or updated ID), you can update your information through our secure portal. |

| What happens if KYC verification fails? | If verification fails, you will receive instructions on how to resolve the issue, which might involve re-uploading documents or providing additional information. |