Financial and banking fraud is a growing problem in today’s world, with wire fraud becoming increasingly common. Fortunately, there are steps you can take to protect yourself from wire fraud. By understanding the different types of fraud, being aware of common scams, and taking measures such as regularly checking your bank accounts, you can help protect yourself against wire fraudsters.

In contrast to the scam activities of the past, such as the Nigerian Prince scam, fraudsters have grown more daring and developed more sophisticated strategies when performing wire fraud. On the other hand, technological advancements in the fight against fraud, have created more options to defend yourself on the web and made it simpler to safeguard your online presence.

Despite this, it is still essential to be aware of certain factors to guard yourself against these criminals. This article will tell you how you can do that.

Table of Contents

ToggleWhat is wire fraud?

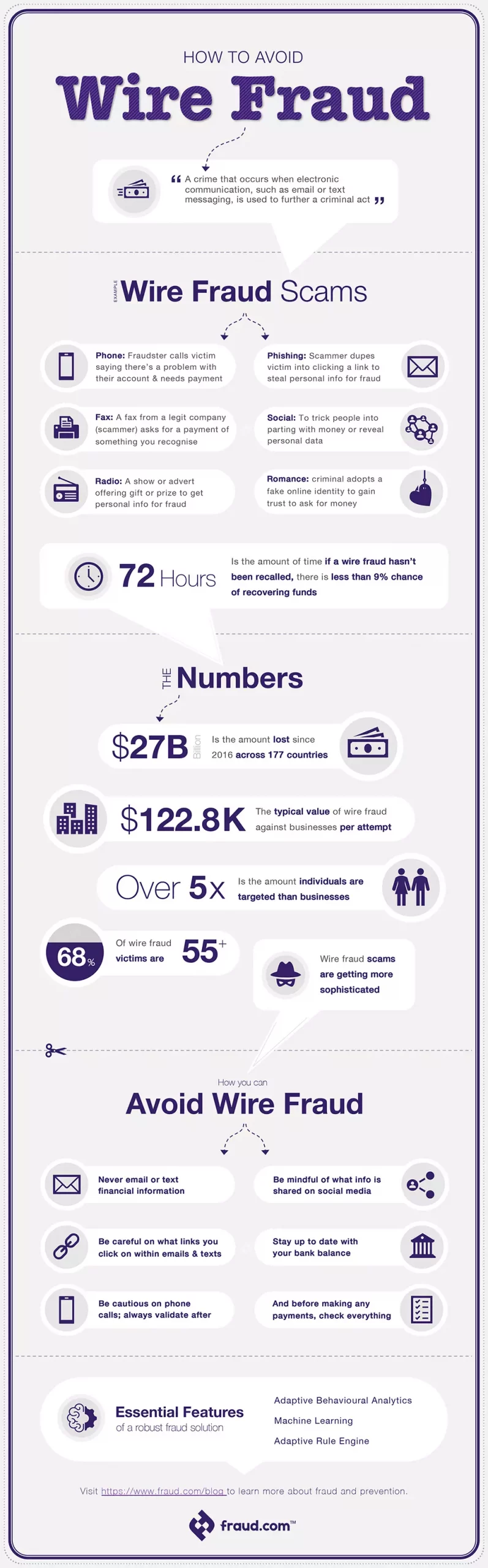

Wire fraud is a type of financial crime that involves the use of electronic communication means such as emails, text messages, and other internet-based communication systems to steal money or personal information from unsuspecting victims. It is a serious problem and committing wire fraud that can result in devastating consequences for individuals, businesses, and governments.

To understand wire fraud better, it is vital to know the seven elements of wire fraud:

- Deception

- False pretences

- Material misrepresentation

- Concealment or nondisclosure of material facts

- False statements or promises made with intent to deceive or defraud another person or entity

- Use of electronic communication to deceive another person

- Interstate wire communication, although this isn’t always the case.

- And obtaining money or property through fraudulent means.

What is the purpose of wire fraud?

Working out the intentions of a highly sophisticated wire fraud fraudster is not easy – even if you manage to recognise them in time. The goal of wire fraud does not always have to be stealing money – it can also be used to pursue other aims like:

- Identity theft: An identity thief uses wire fraud to steal someone’s personal information and use it to go on a spending spree, racking up credit card debt, or even opening bank accounts via account takeover. Identity theft can happen in many ways, including stealing passwords or intercepting data by installing spyware on computers. The thief then uses that information for malicious purposes.

- Money laundering: Money laundering is often used by terrorists, drug traffickers, and other organised crime organisations to keep their illegal income from being traced back to them. Money laundering is often used by terrorists, drug traffickers, and other organised crime organisations to keep their illegal income from being traced back to them. Anti-Money Laundering (AML) is a key procedure to fight Money Laundering.

- Tax evasion: Tax evasion is the process of intentionally avoiding paying taxes by providing false information or hiding assets. It is illegal in every country and can be used for many purposes, including hiding money from the government because it moves quickly, helps avoid detection by authorities, and can otherwise be difficult to track without proper surveillance techniques.

- Bribery and kickbacks: Wire fraud can also be used as a bribe or kickback scheme in which one employee offers a bribe or kickback to another in order to obtain favourable treatment. The bribe will then be passed on for extra pay in order to profit from the difference between the original offered amount and what was actually paid.

- Investment scam: Any time you hear the words “guaranteed returns,” chances are that you are looking at wire fraud of the investment scam type. But because these words are often bandied about so much, these investments can be hard to spot and often lead to devastating financial losses for victims.

The potential success of any type of fraud depends on an assessment of the balance between the possible rewards and the potential repercussions, as well as if it is feasible to perpetrate the crime. Unfortunately, wire fraud is a favourable option for criminals because it can be executed simply, inexpensively, and rapidly.

Examples of Wire Fraud

From phone calls and faxes to text messages, radio broadcasts, television programs, internet messages, social media messages, and emails, wire fraud can take many forms.

- Phone scam: A fraudster calls a victim and claims to be from a legitimate organisation, such as a bank or government agency. The scammer then tells the victim that there is a problem with their account and that they need to transfer money to a certain account to resolve the issue.

- Fax scam: A scammer sends a fax to a victim claiming to be from a legitimate organisation, such as a law firm or a business. The fax contains instructions for the victim to transfer money to a specific account to complete a transaction or resolve a problem.

- Radio: A fake radio show or advertisement claims to be offering a gift or prize to listeners who provide their personal information or make a payment.

- Email phishing: A con artist creates a fake online advertisement or message claiming to offer a gift or prize in exchange for personal information or payment.

- Social media scam: A scammer sends a message to a victim through a social media platform and claims to be from a legitimate organisation or friend. The message contains a link to a fake website or a request for personal information or payment.

You must always be cautious when providing personal information or making payments online and be wary of unexpected or suspicious communications. If you suspect that you have been the victim of wire fraud, you should report it to the appropriate authorities.

What is a wire fraud statute?

The wire fraud statute is a law that outlines what constitutes wire fraud and the penalties associated with it. This law was enacted in 1952 by Congress and applied to any person or entity who uses electronic communications, such as telephone, radio, television, or computer networks, with an explicit intention to commit fraud. It also covers attempts to defraud someone using false or misleading statements made over the phone or via email.

The Wire Fraud Statute can help protect individuals and businesses from financial losses caused by fraudulent activities.

What is a wire fraud conspiracy?

The goal of wire fraud conspiracies is to gain access to money or other assets through deception. In numerous instances, they target unsuspecting individuals with promises of large returns on investments or other financial opportunities that are too good to be true. With the rise in technology and digital communication, it is becoming easier for criminals to perpetrate these types of schemes.

Wire fraud conspiracies can be highly sophisticated and involve multiple individuals working together to perpetrate the fraud. The consequences for those convicted of wire fraud conspiracy can be severe, including jail time and heavy fines.

What is a red flag to fire fraud?

Wire can have disastrous effects on both individuals and businesses. You must recognise the warning signs of wire fraud so that you can take steps to protect yourself and your finances. Knowing what constitutes a “red flag” when it comes to wire fraud can help you spot potentially fraudulent activity before it’s too late.

- Pay particular attention to every email address across the transactions to ensure their legitimacy. This is because wire fraud hackers usually email from unsecured or fake domains with a closer resemblance to actual ones, thereby tricking targets.

- We should further be conscious of sudden alterations in verbiage, terminologies, and grammar. People must watch out for grammatical errors or spelling mistakes, pressure to act fast, and requests for secrecy.

- Payment instructions are also typical red flags. We must be watchful of an unusual amount of payment or requests for payment to odd people, unusual international wires, or individuals.

- We also must review the names of each bank account to ascertain if they match the names of the underlying parties and if it is strangely worded.

- Also, verify alterations to payment instructions and ascertain requests for funds transfer from any person-specifically last-minute wiring alterations from financial institutions.

How do you avoid wire fraud?

Wire fraud is a serious issue that has become more and more common in today’s digital world. It involves criminals sending out fake emails, texts, or other forms of communication to gain access to someone’s bank account or other financial information. To protect yourself from becoming a victim of wire fraud, it is important to be aware of the risks and take steps to protect yourself.

- First, be sure to double-check the source of any suspicious communication. Fraudsters often create emails that look like they are from a legitimate company or financial institution. Check for typos and other signs that may indicate the email is a scam. If you receive a communication that you don’t recognise, contact the sender directly to confirm its authenticity.

- It is also important to be mindful of what information you share online. Never give out your banking or financial information to anyone unless you are certain of their identity. If someone requests this information via email, phone, or any other form of communication, be sure to confirm their identity first.

- When it comes to banking, it is important to stay alert and be aware of any suspicious activity. Regularly review your bank statements for any unexplained activity and set up alerts for any unusual activity. Make sure to use secure passwords and change them periodically.

- Finally, avoid clicking on any suspicious links or attachments in text messages and emails, this can also lead to phishing and smishing. These could be malicious and could install viruses or other malware on your device. If you receive an email or other communication that seems suspicious, delete it right away.

Organisations that want to prevent wire fraud, can adopt fraud detection systems that use advanced technologies such as machine learning to enhance their fraud management and fraud prevention approach. Moreover, it is equally important to verify the identity of users to keep away from wire fraud

These are just a few of the steps you can take to avoid wire fraud. By taking these precautions, you can protect yourself and your finances from scams. Remember, it’s important to stay vigilant and always be aware of the risks of wire fraud.