Identity Verification

in a flash

Udentify Identity Verification

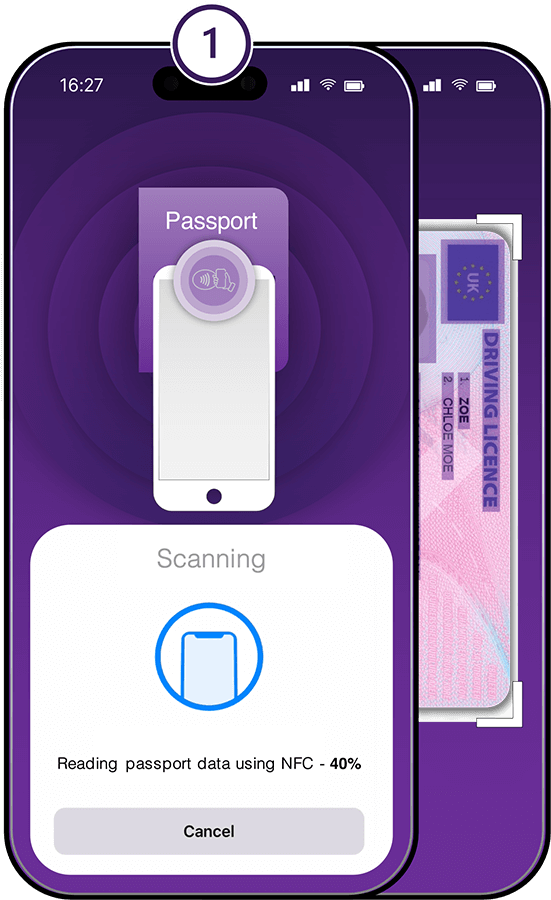

How it works

Scan the presented ID

to determine if it’s

authentic and valid.

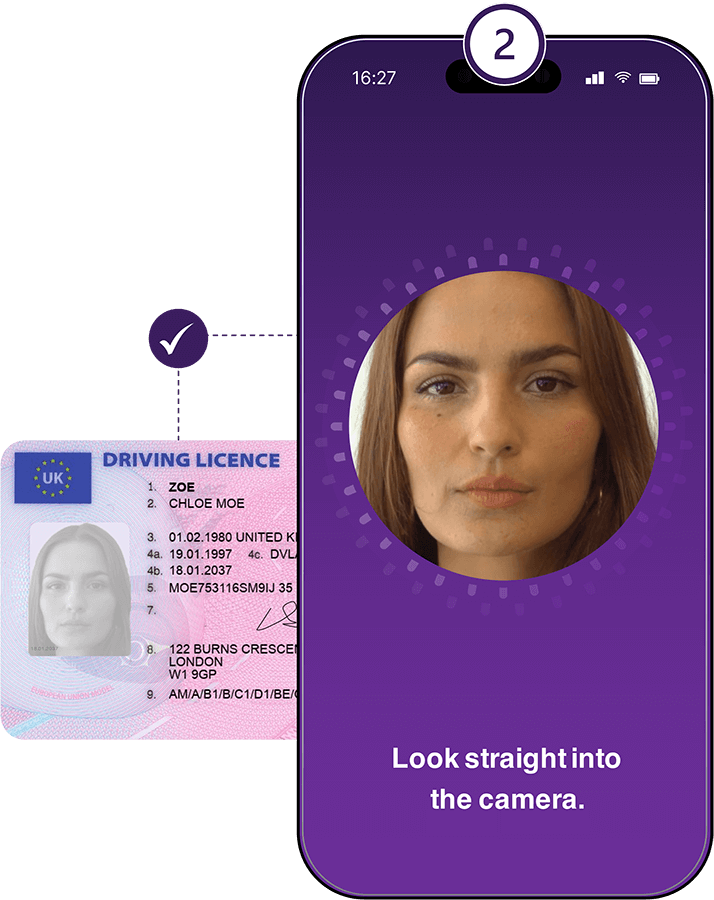

Take a single selfie to match

the presented live users’

face to their validated ID.

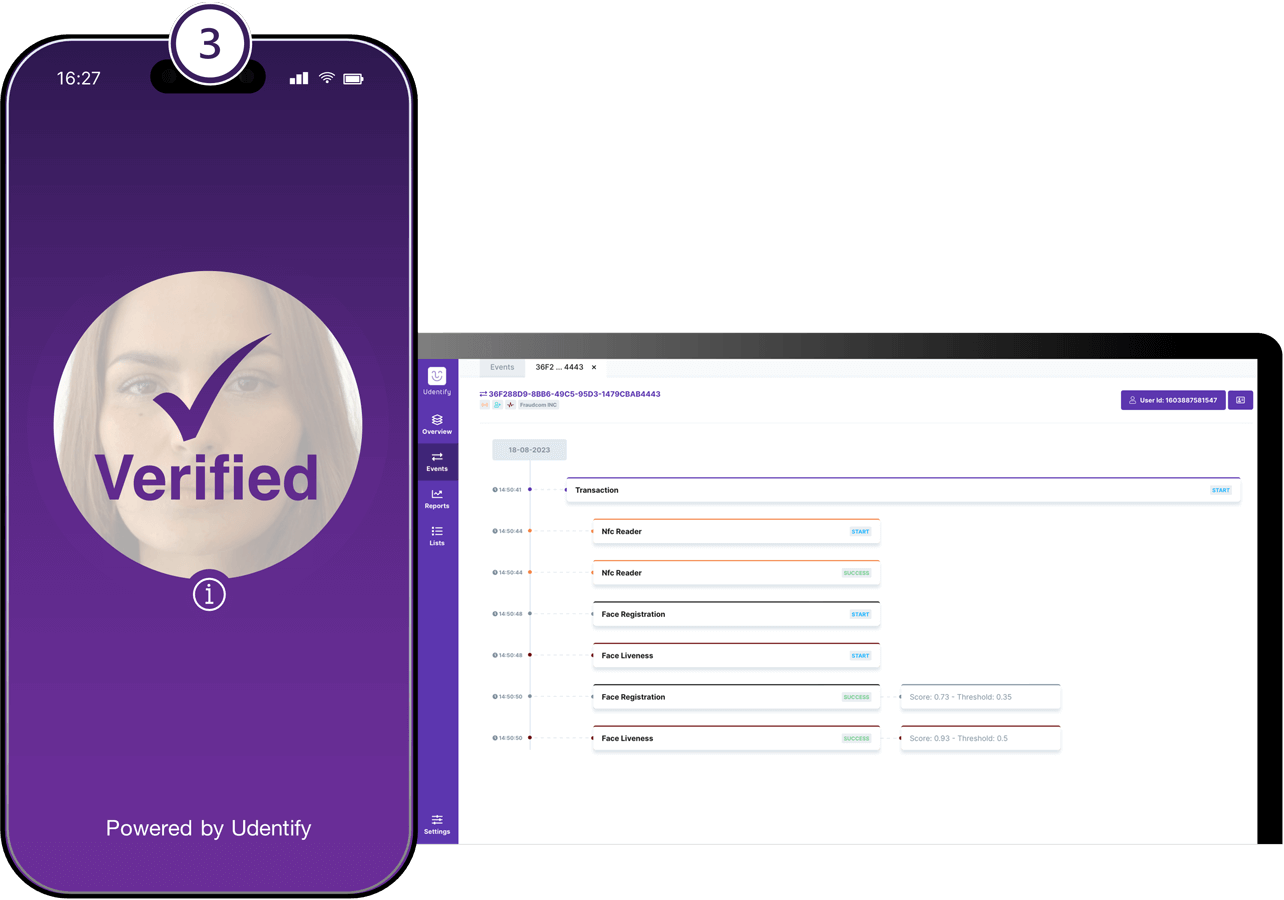

Result.

Results are also available within the Udentify identity admin console.

Features

A multi-layered approach to

digital identity verification.

ID Document Verification.

Tech Specs

← Swipe left to view the content of the table

| Auto-sensing document type. | |||

OCR | NFC | ||

| 13K ID documents supported. | MRZ reader. | ||

| 247 countries/territories supported. | ICAO 9303 Standard. | ||

| Barcode reader. | QR code activation. | ||

| Hologram analysis. | Data protection. | ||

| Ultraviolet & infrared analysis. | Basic access control. | ||

| Geometric pattern analysis. | |||

| Microprint analysis. | |||

Biometric verification.

Tech Specs

| Watch lists. | Face matching/reusable authentication. | ||

| Deep learning-driven AI. | Face identification (1:N). |

| Watch lists. | |

| Face matching/reusable authentication. | |

| Deep learning-driven AI. | |

| Face identification (1:N). |

Liveness detection.

Tech Specs

| Anti-spoofing. | Unbiased results across race, gender, and age. | ||

| Single image analysis. | ISO 30107-3 Level 1 & 2 PAD certified ( Presentation Attack Detection ) |

| Anti-spoofing. | |

| Unbiased results across race, gender, and age. | |

| Single image analysis. | |

| ISO 30107-3 Level 1 & 2 PAD certified ( Presentation Attack Detection ) |

Resources

Keep up to date with the

latest onboarding insights.

What is identity verification?

Why it matters?

How is it implemented across

various sectors?

This article provides a

comprehensive guide to

understanding key identity

verification regulations.

Case Study

FAQ

Identity verification is the process of confirming that an individual’s identity is genuine. It is commonly

used in financial transactions, such as opening a bank account, and it enables individuals to conduct

business with or provide services to the verified person.

ID verification software is essential for KYC and AML compliance and fraud detection programs while

streamlining onboarding processes and reducing manual workload. Here are the main benefits of

identity verification:

Delivering fast, frictionless customer experiences.

Identity verification gives customers quicker and easier access to your services when onboarding and

authenticating, positively impacting their experience with your company while feeling safer.

Preventing fraud.

In today’s digital world, verifying a customer’s real-world identity against their digital identity is crucial

when signing up for your services and accessing them to prevent fraud.

Compliance.

Our solution provides a basis for customer due diligence in business KYC onboarding programs, PSD II

Strong customer authentication and AML.

Reduce costs and losses.

Speeding up the onboarding process, removing manual, repetitive tasks, removing password resets,

and reducing fraud and account takeover.

An artificial intelligence-assisted verification method that detects whether the presented person is a

live person and not a spoof (i.e. video, image or mask). Udentify passive liveness detection works in the

background to speed up the onboarding, age verification and authentication process. It also; does not

present the technology to fraudsters to leave doubt in their mind, as no fraudster likes to show their face.

Udentify passive liveness detection is iBeta ISO 30107-3 Level 1 & Level 2 certified, delivering the

confidence that only your onboarded live customers can access your services.

Customers who prove their identity via onboarding or biometric authentication can view their results on

their device screen at the end of their process. In addition, vendors can view customer results through a

web-based solution or an integrated API.

Ready for the new era of identity, authentication and fraud prevention?

Our experts are here to answer your questions and help you with every step to make sure fraud.com solutions are suitable for your needs.

Complete the form on the right, and we will contact you back as soon as possible.

Customers