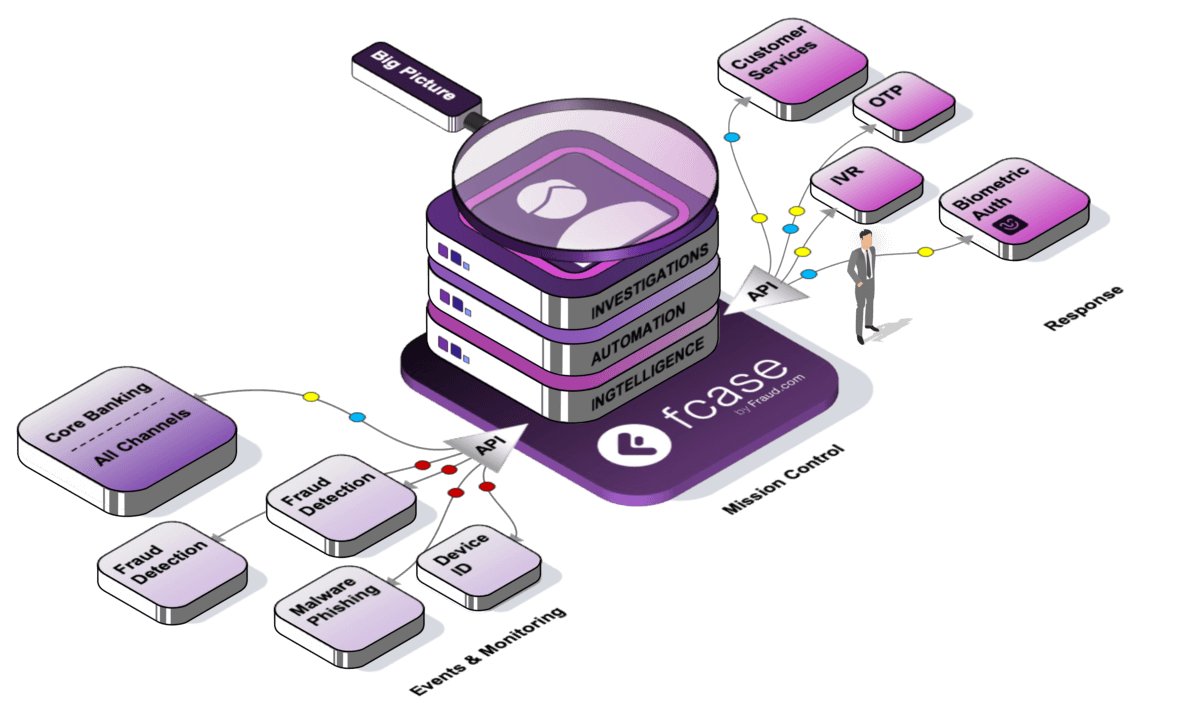

Delivering true end-to-end fraud protection for Account Opening, login, Activity and Orchestration.

fcase fraud mission control

Bringing order to the chaos of fraud prevention operations

fcase mission control combines your defences to help you better manage fraud prevention more effectively and efficiently.

fcase Fraud Mission Control:

Menu

See the big picture of fraud.

Meet a single attack with a united defence.

Less friction, less fraud, less inefficiencies.

One mission control, three distinct layers.

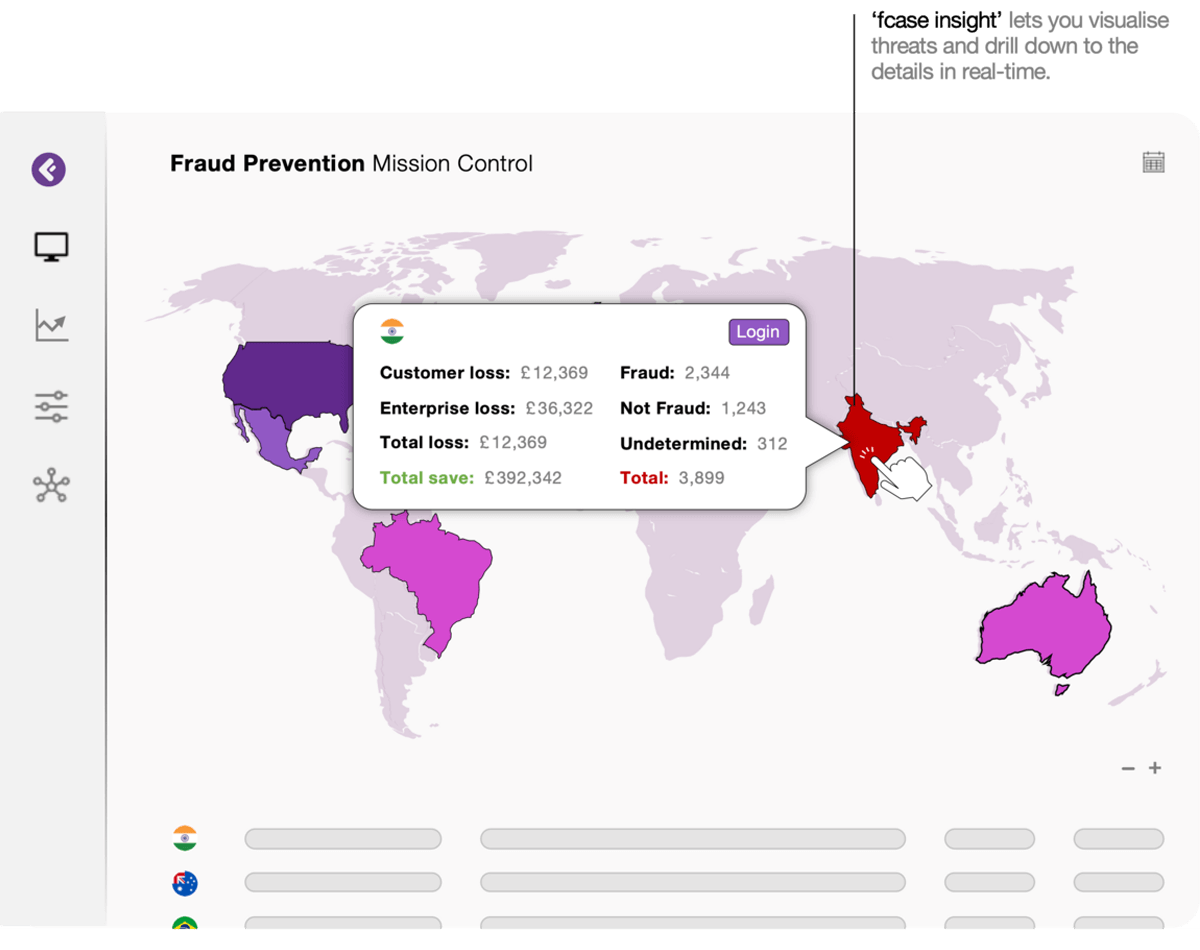

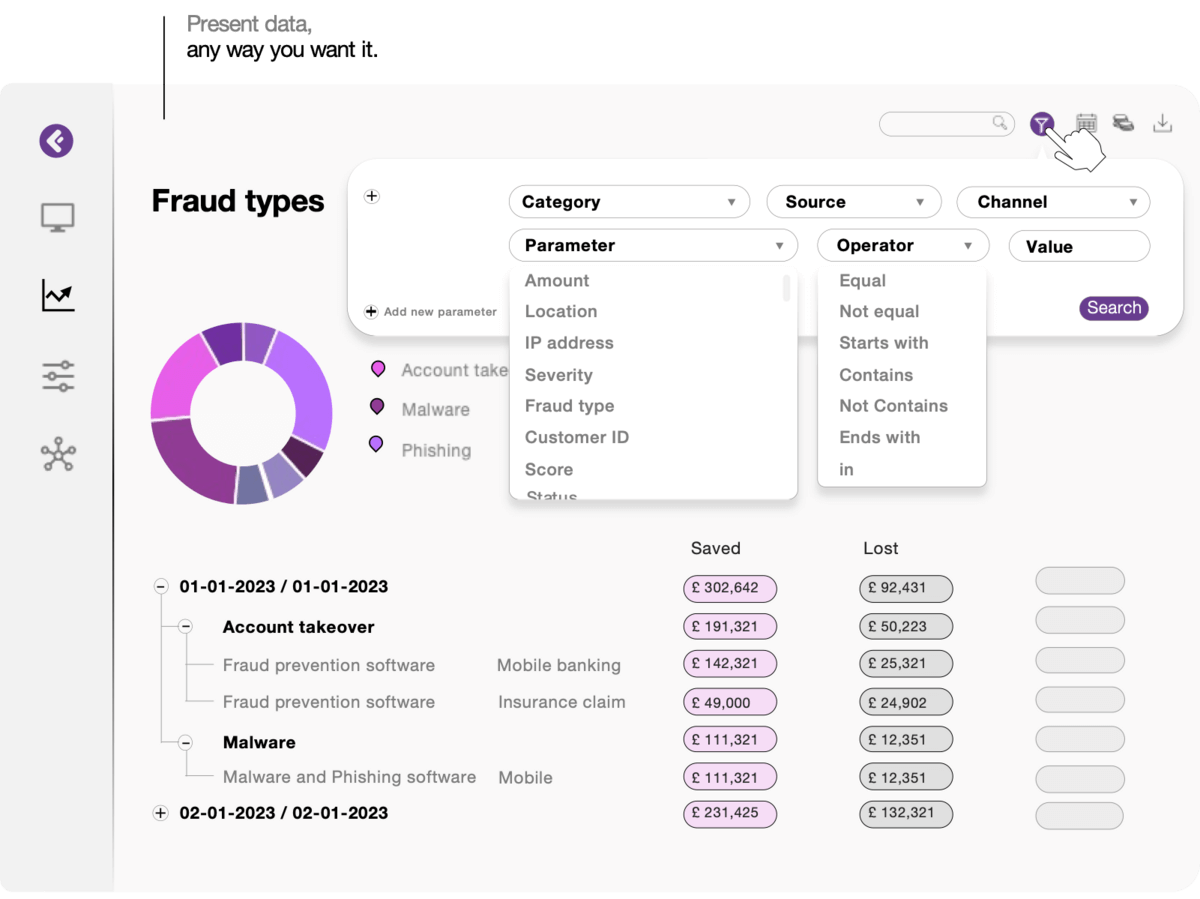

HOW IT WORKS > FCASE INSIGHT

A holistic view of fraud prevention.

Bringing your data to life.

With ‘fcase Insight’, you can have up-to-the-minute knowledge of your organisation’s fraud prevention efforts. Allowing you to make informed decisions, concentrate on your defences, evaluate performance, identify weaknesses and, importantly, strike the right balance between risk and trust.

Comply with confidence

SAR, STR, CTR, and PSD2 reports are automatically generated based on triggered events and then sent to your regulator.

Evoluate performance

Track prevention performance from systems to teams, to individual investigators.

Comply with confidence

SAR, STR, CTR, and PSD2 reports are automatically generated based on triggered events and then sent to your regulator.

Evoluate performance

Track prevention performance from systems to teams, to individual investigators.

Imagine what you can do with a single source of truth!

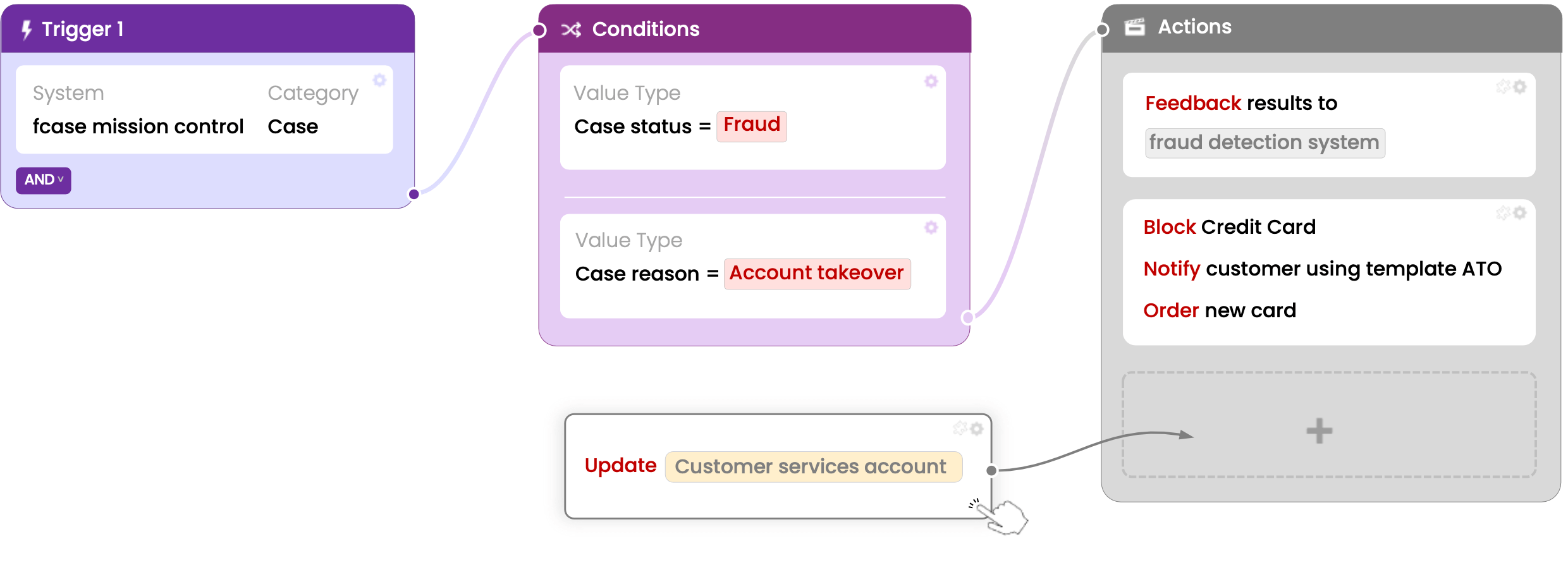

HOW IT WORKS > FCASE AUTOMATE

Automate to reduce risk.

Improve customer experiences.

Streamline tasks.

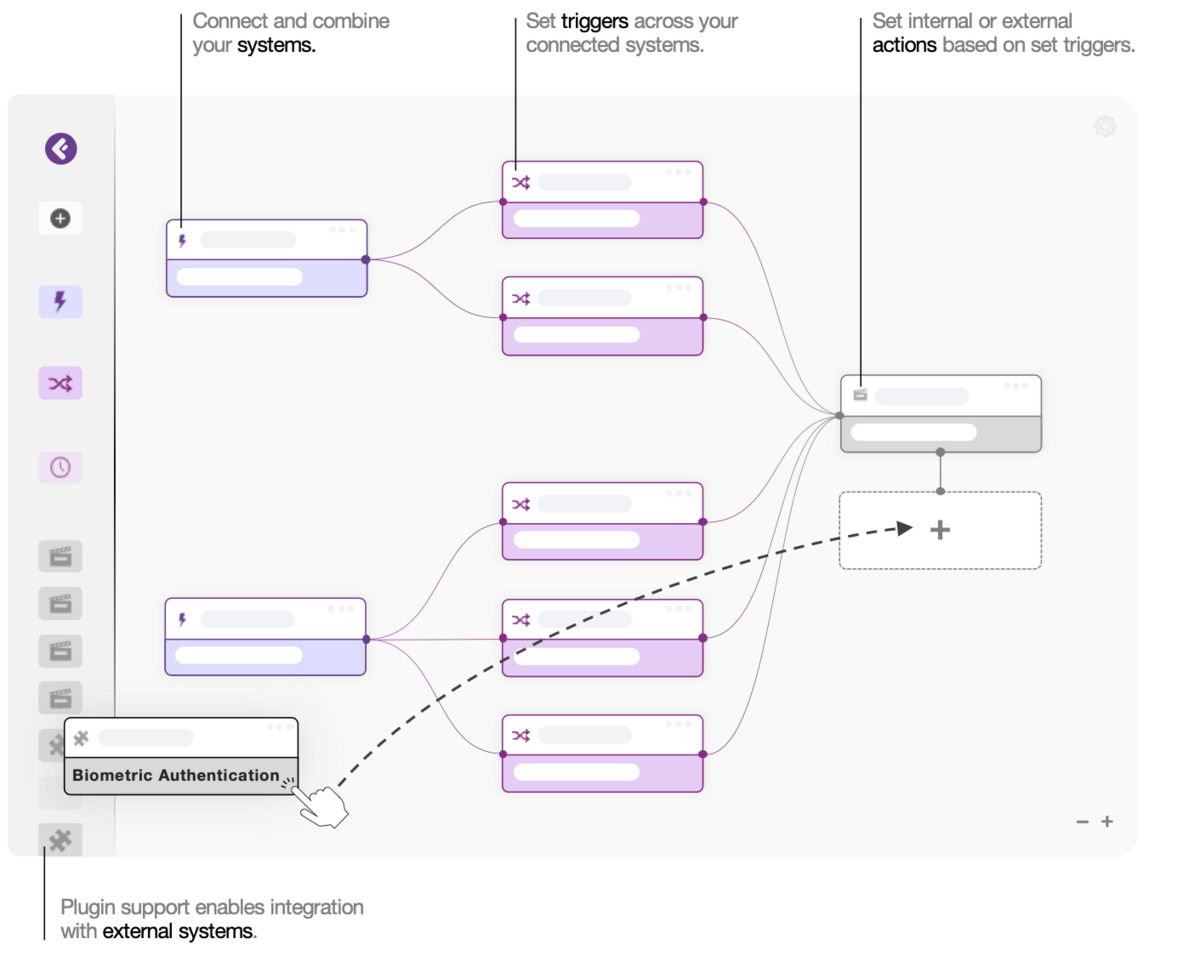

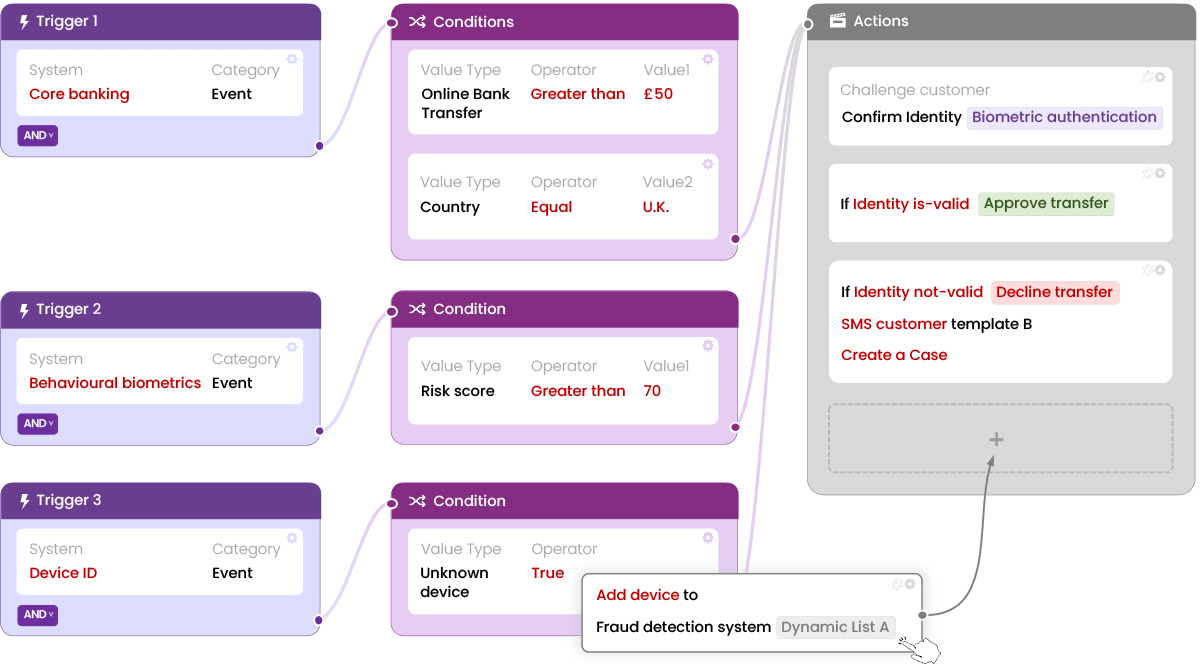

One platform, endless automation

‘fcase automate’ arms your fraud prevention operations with one powerful and deliver consistent outcomes across your enterprise. codeless drag-and-drop editor to connect and combine your risk systems and deliver consistent outcomes across your enterprise.

Automate to deliver a unified fraud response.

Combine your operational, anti-fraud, AML, identity, and cybersecurity data to automate real-time decision-making across the digital user journey.

Automate to improve efficacy and efficiency.

Time is money, as the saying goes.

Free your operational resources up from repetitive tasks to reduce costs, increase productivity, improve visibility and reduce errors.

Free your operational resources up from repetitive tasks to reduce costs, increase productivity, improve visibility and reduce errors.

What will you automate?

HOW IT WORKS > FCASE INVESTIGATE

Unified case management.

Purposely built for fraud operations.

One view of the customer and associated risks to help you fight fraud more effectively and efficiently. One ticket queue to adaptively prioritise and automatically assign cases. One holistic search engine so investigators can truly see. One single source of truth across all your channels with centralised APIs to avoid tunnel vision and blind spots. One feedback loop enriching your defences. One technology stack, integration point and licence to save time and money. One flexible omnichannel case management toolto familiarise, collaborate and grow with. Everything is in its place so you can remove those gaps that fraudsters exploit and deliver better customer experiences.

Up to

8x

More efficient investigations

Up to

4x

Operational cost savings

Threat-Centric cases

Designed to make

a difference

Context is everything when investigating, and threatcentric cases deliver, fusing all alerts and events by threat, so fraud investigators can stay focused and avoid being overwhelmed by multiple screens, excessive data and blind spots, resulting in fewer cases, fraud loss, false positives and energy – the ultimate investigation experience.

Link analysis, geo-location, fraud storyboards

Connecting the dots.

Incorporating threat intelligence at each investigation stage, including the actions taken by whom, where and when among all the entities involved. And with full context, you will always have what you need to see and stop fraud fast.

Ready to respond to threats more effectively and efficiently?

Benefits

Single source of truth.

Removes tunnel vision, blind spots and wasted energy. Integral in the fight against fraud across all departments.

Uplifting user experiences.

Users can feel more protected, minus unnecessary friction, by uniting risk signals and events to drive well-balanced risk and trust assessments across the digital user journey.

Boosting productivity.

One example of many: Fraudster attacks a customer, fraud system(s) raise 7 alerts for manual review, which equals 7 cases for 7 investigators, total review time: 40min, and 2 wrong decisions as they are working in siloes. With fcase, this would be 7 alerts, 1 threat-centric case, 1 investigator and 2min to review with no errors.

Contact us for more examples →

Contact us for more examples →

Reducing risk.

From reducing false positives, false negatives, fraud loss, time, and reputational risk to operational risk.

Reducing costs.

Say goodbye to the silo effect that drains your resources. Management will have the big picture, investigators are more effective and efficient, IT will be more streamlined with a single front-end, and fraud loss will significantly decrease and remain under control.

Intelligence all around.

It’s challenging to manage what you can’t see, and you can’t secure what we can’t manage. fcase has the extensive fraud reporting, and compliance needs to fight fraud effectively.

Resources

Case Study

Challenge

A top-tier bank – isBank aimed to reduce fraud loss, customer friction, enhance operational efficiency and future-proof its fraud operations.

Results

Centralised intelligence, automation and investigations, delivering:

3x

More fraud case processed

9x

faster fraud investigations

United

Back and front end systems to deliver a fraud mission control

30%

Less fraud

FAQ

What is fcase fraud mission control ?

fcase fraud mission control (AKA fraud orchestration) integrates operational, anti-fraud, identity, and cyber tools to create a central mission control that provides a single source of truth. This helps improve the customer experience while reducing fraud and operating costs.

Why use a fraud mission control ?

As an organization grows, its fraud prevention measures can become more complicated to sustain. With the introduction of new business channels, outdated systems that need replacing, and the need to fine-tune modern systems, managing fraud prevention can become overwhelming. This issue is compounded when the organization operates across multiple countries and involves numerous people, leading to a disjointed approach that can be chaotic.

By breaking down siloes, a fraud mission control unites your defences and provides a single source of truth. This results in a highly efficient fraud foundation that reduces fraud loss and improves both customer experiences and the day-to-day activities of fraud professionals.

By breaking down siloes, a fraud mission control unites your defences and provides a single source of truth. This results in a highly efficient fraud foundation that reduces fraud loss and improves both customer experiences and the day-to-day activities of fraud professionals.

Is fcase modular ?

fcase fraud mission control has three modules: Intelligence, Automation, and Investigations.

– Intelligence offers a big-picture overview of fraud across the entire fraud stack.

– Automation assesses user risk and streamlines operations.

– Investigations centralise case management to reduce fraud loss and speed.

– Intelligence offers a big-picture overview of fraud across the entire fraud stack.

– Automation assesses user risk and streamlines operations.

– Investigations centralise case management to reduce fraud loss and speed.

How easy is it to integrate fcase ?

fcase fraud mission control glues systems together so they can sing in harmony. The systems being glued, in reality, are varied and full of specific integration points and data sets.

At fraud.com, we understand that every customer is different; our team has decades of experience uniting systems to form a central view, and we built fcase fraud mission control for this job. We have a myriad of connectors and APIs for your various defences, ranging from JSON, XML, TCP/IP Socket, DB, CSV and Kafka; furthermore, flexible data tools to map, label and mask so you can get your data just as you want it.

At fraud.com, we understand that every customer is different; our team has decades of experience uniting systems to form a central view, and we built fcase fraud mission control for this job. We have a myriad of connectors and APIs for your various defences, ranging from JSON, XML, TCP/IP Socket, DB, CSV and Kafka; furthermore, flexible data tools to map, label and mask so you can get your data just as you want it.

What are threat-centric cases ?

A threat-centric approach consolidates all alerts and their related data to provide a complete context or story; this enables a single investigator to conduct a faster and more accurate assessment than multiple investigators.

Here is just one example of a typical attack:

A fraudster (Jack) takes over (Jason’s) bank account (ATO). Firstly Jack sends Jason an email (Phishing). Jason clicks a link in the email (and ends up with malware); this malware captures his keystrokes on his device and sends them to Jack, which contains some personal information and login credentials. Jack then logs into Jason’s bank account; during login, the bank defences detected a new device and behavioural change, so when Jack made an external money transfer, the bank sent a one-time password to confirm it was Jason; nevertheless, Jack already had compromised Jason’s phone number, and Jack receives the one-time password so he can carry on with the transaction / fraud.

In the example above, the typical alert-centric approach evaluates fraud cases individually, missing any relationships between them, leading to higher fraud loss, more extended investigations, wrong decisions made, higher investigation costs and more customer friction.

In the threat-centric approach, the example above would be one threat and, therefore, one case with the full context. The net result is that the customers are better protected, and less money is lost and spent.

Here is just one example of a typical attack:

A fraudster (Jack) takes over (Jason’s) bank account (ATO). Firstly Jack sends Jason an email (Phishing). Jason clicks a link in the email (and ends up with malware); this malware captures his keystrokes on his device and sends them to Jack, which contains some personal information and login credentials. Jack then logs into Jason’s bank account; during login, the bank defences detected a new device and behavioural change, so when Jack made an external money transfer, the bank sent a one-time password to confirm it was Jason; nevertheless, Jack already had compromised Jason’s phone number, and Jack receives the one-time password so he can carry on with the transaction / fraud.

In the example above, the typical alert-centric approach evaluates fraud cases individually, missing any relationships between them, leading to higher fraud loss, more extended investigations, wrong decisions made, higher investigation costs and more customer friction.

In the threat-centric approach, the example above would be one threat and, therefore, one case with the full context. The net result is that the customers are better protected, and less money is lost and spent.

What is a Suspicious Activity Report (SAR) and Suspicious Transaction Report (STR)?

Financial institutions are required by law to file a Suspicious Activity Report (SAR) or Suspicious Transaction Report (STR) when they detect any suspicious or potentially suspicious activity related to money laundering, financing of terrorism, or other financial crimes. The criteria for reporting vary from one country to another but generally include any financial transaction that is either:

These reports are submitted to the financial crime enforcement agency of the respective country, which is responsible for collecting and analyzing transactions and reporting them to relevant law enforcement teams.

- Does not make sense to the financial institution.

- Unusual for that particular client.

- Designed to conceal or obscure another transaction.

These reports are submitted to the financial crime enforcement agency of the respective country, which is responsible for collecting and analyzing transactions and reporting them to relevant law enforcement teams.

What is a Currency Transaction Report (CTR)?

To prevent money laundering, banks use a form called a currency transaction report (CTR). A bank representative must complete this form whenever a bank customer attempts a currency transaction above a certain amount. This is part of the banking industry’s responsibility to combat money laundering. To prevent financial crimes, CTRs require institutions to verify the identity and Social Security numbers of anyone attempting a significant transaction, regardless of whether they have an account with the institution.

What Is the Payment Services Directive 2 (PSD2) - incident reporting (Article 96)?

Payment service providers must provide statistical data on payment fraud to regulatory authorities annually.

Ready for the new era of identity, authentication and fraud prevention?

Our experts are here to answer your questions and help you with every step to make sure fraud.com solutions are suitable for your needs.

Complete the form on the right, and we will contact you back as soon as possible.

Get in touch

Customers